AIoT in Logistics: Real Cases, ROI, and a Pilot Playbook

AIoT delivers in logistics when it cuts empty miles, kills dwell time, and makes ETAs honest.

- connected trucks and trailers(ELD/telematics, fuel and tire sensors);

- pallet and parcel trackers (BLE/RFID/NFC);

- dock and yard sensors, cameras, temperature probes,

- and much more.

That’s how modern AIoT looks.

This article continues our cross-industry AIoT series– after manufacturing, healthcare, and agriculture, we turn to logistics.

Expect recent, real-world cases with hard numbers, a KPI framework, and a copy-paste cost-vs-benefit example you can adapt to your fleet or network.

No fluff, no vendor pitch-just steps, numbers, and patterns you can apply from experts in the custom IoT development.

The Wave of Innovation – How AI-Powered IoT Looks in Logistics

We would like to start by examining two real-life examples and the positive effects of AIoT on logistics:

- United Parcel Service – route optimization for a global logistics and courier company;

- Midwest Logistics – predictive maintenance system for a U.S.-based third-party logistics provider.

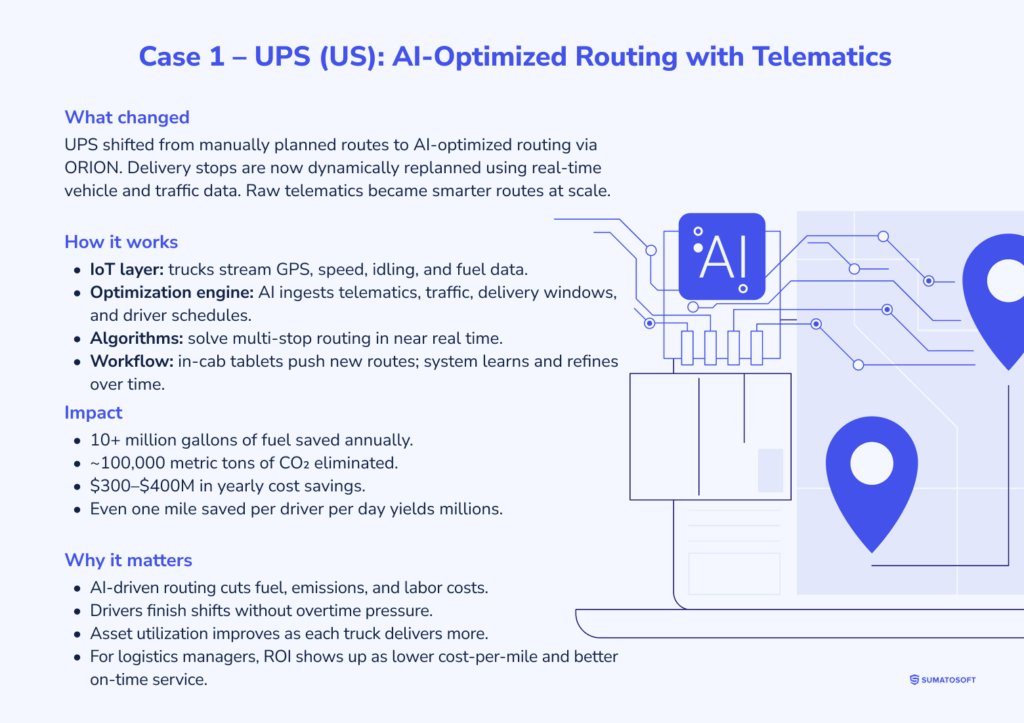

Case 1: UPS: AI-Optimized Routing with Telematics

What changed: UPS equipped its delivery fleet with connected telematics devices and launched the ORION platform (On-Road Integrated Optimization and Navigation). Instead of manually planned stops, drivers now follow AI-generated routes. The change enabled UPS to dynamically replan hundreds of thousands of daily stops based on real-time data – turning raw vehicle sensors into smarter routes.

How it works: Trucks stream rich IoT data (GPS location, speed, idling time, fuel usage, etc.) to UPS’s central system. An AI/optimization engine ingests this telematics data along with traffic, delivery windows and driver schedules. Using advanced algorithms, ORION solves the multi-stop routing problem in near real time. It then pushes new route instructions to in-cab tablets for each driver. Over time, ORION “learns” from outcomes and refines routes further.

Impact: The results have been dramatic. UPS reports that ORION has shaved off 10+ million gallons of fuel per year and roughly 100,000 metric tons of CO₂ annually. In practice, this translates to about $300-$400 million in cost savings each year. Even eliminating a single mile per driver per day can save tens of millions of dollars company-wide, and ORION consistently finds those gains.

Why it pays off: By tying vehicle sensor data to AI routing, UPS cut operating costs and emissions while improving delivery consistency. Shorter, more efficient routes mean less fuel burn and fewer truck-hours wasted (drivers can complete shifts without rushing or overtime). In effect, the fleet’s asset utilization rises – each truck delivers more for less. For logistics managers, the value is concrete: lower cost-per-mile and better on-time service, achieved by automating what used to be manual route planning.

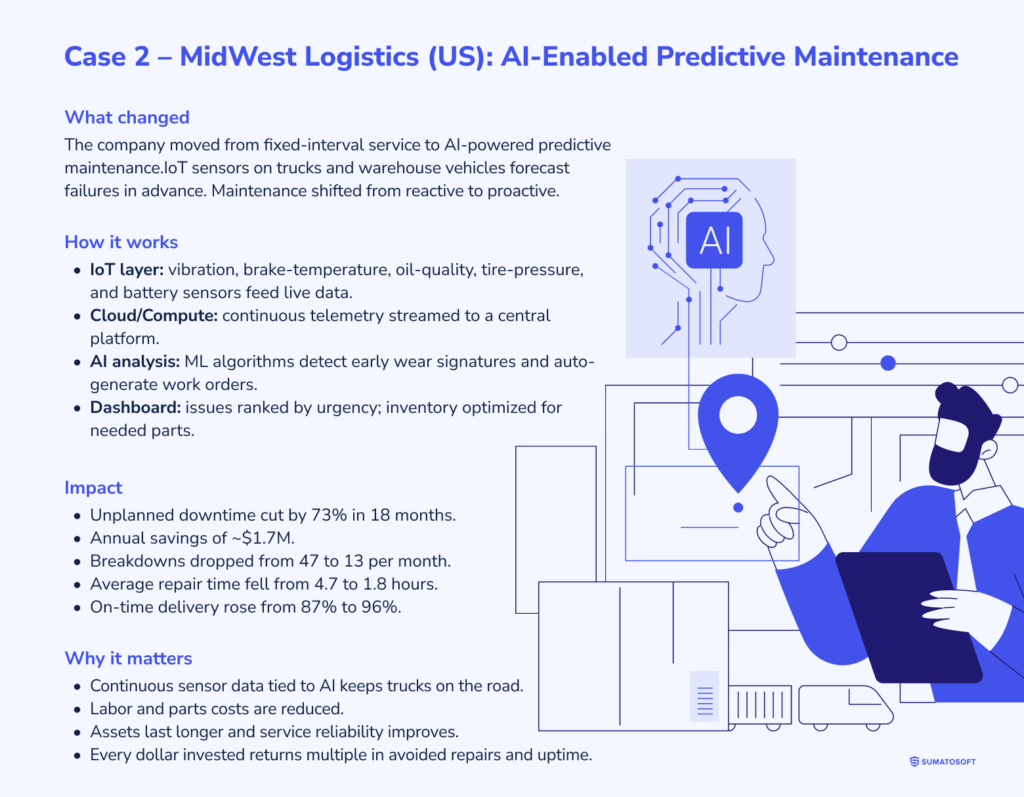

Case 2: Midwest Logistics: AI‑Enabled Predictive Maintenance

What changed: A mid-sized U.S. carrier (“MidWest Logistics”) moved from fixed-interval maintenance to an AI-powered predictive approach. Instead of scheduled oil changes or inspections by mileage, they installed IoT sensors on each truck and warehouse vehicle. Now, machine-learning models forecast failures in advance. The shift transformed maintenance from reactive to proactive.

How it works: Hundreds of IoT sensors (vibration sensors on engines/transmissions, brake-temperature probes, oil-quality monitors, tire-pressure sensors, battery health monitors, etc.) feed live data every few seconds into a cloud platform. AI/ML algorithms analyze this telemetry to spot “signatures” of wear or failure long before breakage (for example, recognizing a telltale engine-vibration pattern that predicts bearing failure 150 hours in advance). When a fault is predicted, the system alerts maintenance staff and auto-generates work orders. The dashboard ranks predicted issues by urgency, and even optimizes parts inventory to have needed spares on hand. In short, IoT data triggers AI analysis which in turn drives a smarter maintenance workflow.

Impact: Within 18 months, MidWest Logistics cut unplanned equipment downtime by 73% and achieved roughly $1.7 million in annual cost savings. Detailed metrics showed monthly breakdowns plummeting (47=>13, a 72% drop) and average repair time falling 4.7=>1.8 hours. On-time delivery rates climbed (from 87% to 96%), and customer satisfaction rose accordingly. These gains came from fewer on-road breakdowns (saving thousands in emergency repairs) and optimized work schedules (avoiding unnecessary part replacements).

Why it pays off: By tying continuous sensor data to AI analysis, the company avoided most unexpected failures. This meant trucks stayed on the road, not in the shop – directly boosting revenue and service levels. Technicians waste far less time on needless maintenance, so labor and parts costs drop. In effect, every dollar invested in sensors and AI yields multiple dollars saved in avoided repairs and uptime. The result is a leaner maintenance process, longer asset life, and smoother operations – a clear win for the bottom line.

Where AIoT Pays Off in U.S. Logistics

AIoT is one of the modern tech trends in logistics. AIoT is when sensors, vehicles, and warehouses connect into systems that see and act. Telematics, temperature probes, RFID tags, and robots stream data into models that forecast, optimize, and automate.

The result of the Internet of Things in logistics development is lower spoilage, faster order cycles, leaner fleets, and tighter inventory control. The table below shows where AIoT makes the biggest difference in U.S. logistics, how it works, and what kind of ROI leaders can expect.

| Item | Cold chain monitoring | Warehouse efficiency | Fleet optimization | Inventory accuracy |

|---|---|---|---|---|

| AIoT usage | Temp/humidity sensors in trailers, warehouses, packaging; GPS trackers; refrigerated truck telematics; cloud dashboards. | RFID, smart shelves, weight sensors; AMRs/AGVs, barcode scanners, cameras; IoT conveyors/HVAC. | Telematics (GPS, engine diagnostics, driver behavior); IoT dashcams, cargo sensors, traffic/weather feeds. | RFID tags/readers, shelf weight sensors; scanning robots/drones, shelf cameras. |

| AI methods | ML anomaly detection, spoilage prediction; CV for packaging integrity; RL for rerouting; predictive maintenance. | Deep learning for forecasting/slotting; CV for automated picking; RL for robot routing; predictive analytics for maintenance. | ML ETA prediction & traffic forecasting; RL for dynamic routing; CV in dashcams; ML predictive maintenance. | CV for recognition/counting; ML demand forecasting; anomaly detection; RL for restocking optimization. |

| ROI impact | Spoilage cut up to 70%; OPEX down 20-30%; fewer manual checks; prevent multimillion-dollar losses. | Labor costs down >33%; throughput doubled; accuracy 95%; stockouts down 75%; lead times −20-40%. | UPS ORION saved $300-400M/yr; 100M miles & 10M gal fuel cut; SMB fleets fuel −19%, ROI 257% in 3 months. | Accuracy 95-99% (vs 85-90%); stockouts −75%; +1% accuracy adds 2-3% revenue. |

| U.S. examples | Cold Chain Tech + ParkourSC: 300M+ vaccine doses tracked with IoT sensors, preventing waste. | Natural foods distributor: IoT + AI raised accuracy to 95%, cut labor 1/3. | UPS ORION: AIoT routing; SMB fleets (Zubie) cut accidents 15%, fuel 19%. | Walmart Bossa Nova robots hit ~99% shelf accuracy; distributor cut stockouts 75%. |

Building the Next Successful AIoT Case in Logistics

Logistics wins with AIoT when it turns raw signals-GPS/ELD traces, stop scans, reefer temps, yard tags, dock cameras-into fewer delays, fewer empty miles, and fewer claims. This section is a fast lane from “interesting data” to one pilot that moves OTD, detention, cost per delivery, and spoilage in 30-90 days.

You’ll get three things:

- the real pain signals that justify AI;

- scenarios where AI won’t pay yet;

- a 1-week opportunity scan to pick and scope a pilot-owner named, data confirmed, control hooks defined, edge vs cloud decided, and a one-pager ready to sign.

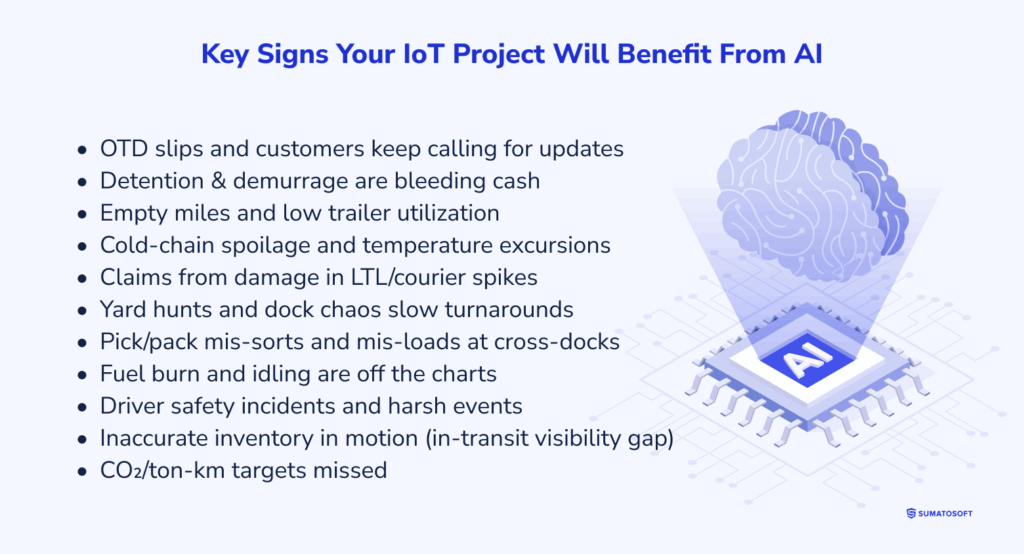

A) Key Signs Your IoT Project Will Benefit From AI

- otd slips and customers keep calling for updates – IoT data/devices: GPS pings, ELD/telematics (CAN bus), stop scans, geofences. AI unlocks: high-accuracy ETA predictions per stop, proactive delay alerts, dynamic re-sequencing to hit time windows;

- detention & demurrage are bleeding cash – IoT data/devices: gate-in/out timestamps, yard RFID/UWB, terminal APIs, AIS vessel tracking. AI unlocks: arrival/turn-time forecasts, auto-rescheduling of appointments, heatmaps of “detention hotspots,” playbooks by lane/terminal;

- empty miles and low trailer utilization – IoT data/devices: trailer RTLS/BLE tags, load sensors, TMS lane history. AI unlocks: backhaul matching and consolidation suggestions, repositioning plans, utilization uplift predictions;

- cold-chain spoilage and temperature excursions – IoT data/devices: reefer temp/RH probes, door sensors, fuel levels, shock/vibration loggers. AI unlocks: excursion risk scoring by route/ambient, predictive alerts, auto-tuning setpoints and fan cycles (when control is available);

- claims from damage in LTL/courier spikes – IoT data/devices: accelerometers, shock indicators, pallet tags, dock cameras. AI unlocks: anomaly detection for rough handling, root-cause tracing to dock/leg, handling guidance to reduce impact events;

- yard hunts and dock chaos slow turnarounds – IoT data/devices: UWB/RFID yard tags, gate readers, dock sensors, yard cameras. AI unlocks: trailer/spot prediction (“where it will be next”), dock-door assignment optimization, queue time forecasts;

- pick/pack mis-sorts and mis-loads at cross-docks – IoT data/devices: handheld scans, fixed readers, vision at chutes/doors. AI unlocks: real-time barcode/label vision checks, mis-sort detection, auto-alert and re-route before truck departure;

- fuel burn and idling are off the charts – IoT data/devices: fuel flow meters, engine telemetry, PTO status, slope/traffic data. AI unlocks: route and speed profile optimization, stop-level idle reduction tips, driver-specific coaching with measurable savings;

- driver safety incidents and harsh events – IoT data/devices: dashcams, ADAS events, accelerometer/gyro, weather feeds. AI unlocks: risk scoring by segment/driver, predictive “high-risk minute” alerts, targeted coaching and reroutes around risk zones;

- inaccurate inventory in motion (in-transit visibility gap) – IoT data/devices: pallet/case RFID, BLE beacons, eSeals, weigh-in-motion. AI unlocks: probabilistic item-level location, loss/theft anomaly flags, auto-reconciliation with WMS/TMS;

- co₂/ton-km targets missed – IoT data/devices: fuel/energy meters, load weight, route gradients, dwell times. AI unlocks: carbon-aware routing and consolidation, scenario sims to hit emission targets with cost trade-offs.

B) When AI Is Overkill (For Now)

- fixed, repeatable routes with stable demand (micro-fleets) – if 8 vans run the same milk-run daily, static heuristics beat ML on cost/benefit;

- no actuation path – if you can’t change appointment slots, driver instructions, reefer setpoints, or dock assignments, insights won’t move outcomes;

- thin or messy history – weeks of GPS and almost no labeled outcomes (OTD, claims, detention) => models won’t generalize; start with rules and better capture;

- trackers drop out often – if 30-40% of assets go dark due to power/coverage, fix devices/connectivity before forecasting ETAs or risks;

- warehouse lacks consistent IDs – no item/pallet barcode discipline? vision/ML for mis-sorts or slotting won’t pay until scanning basics are in;

- cold chain uses passive loggers only – if you can’t alert or control in trip, AI can’t prevent spoilage-invest in live sensors first;

- high compliance sensitivity with no explainability plan – driver scoring that affects pay/discipline needs clear, auditable logic; if legal/compliance isn’t ready, pause AI;

- one-off pilots with no owner – if dispatch, dock, or quality won’t change behavior based on alerts, dashboards become shelfware.

C) Run a 1-Week Opportunity Scan (Fast Path)

Day 0 (90 min) – Frame the win.

People: fleet ops/dispatch, warehouse lead, TMS/WMS owners, IT/data, safety/compliance, quality (cold chain), finance.

Output: top 3 pains + hard targets, e.g., OTD +3-5 pp, detention −20%, empty miles −10%, cold-chain excursions −50%, claims −30%, fuel −8-12%, CO₂/ton-km −10%. Pick one scope (e.g., “reefer lanes to DC-3” or “yard at Site A” or “last-mile zone W2”).

Days 1-3 – Prove data, integrations, and control.

- data reality check – 6-12 months of GPS/ELD traces; stop-level timestamps; fuel & idle; reefer temp/door; yard gate IO; WMS pick/pack/ship; TMS orders/appointments; claim/detention invoices; weather/traffic history;

- labels/outcomes – on-time vs promised, minutes late, detention hours, excursion counts, claim codes, $ impact;

- integrations – TMS/WMS/ERP APIs, telematics (e.g., Samsara/Geotab/Verizon), yard systems, dock scheduler, driver app;

- constraints – GDPR/driver privacy, HOS, DG/pharma GDP, FSMA/HACCP, safety & explainability, union rules;

- control path – can we push actions? (driver messages, dock slot edits, reefer commands, yard moves). Kill candidates lacking history, integration, or an accountable owner.

Day 4 – Pick the pilot.

Choose one high-ROI, feasible case with control authority and a named owner. Examples:

- ETA + appointment optimizer for DC-3 – reduce late arrivals 30%, detention −20%;

- cold-chain risk scoring + auto-alerts on lanes X/Y – excursions −50%;

- yard RTLS + camera AI – turn time −15%, “find time” −60%;

- backhaul/pooled consolidation recommender – empty miles −12%.

Decide edge vs cloud (e.g., in-cab inference for driver coaching; cloud for ETA/slotting).

Day 5 – One-pager you can sign.

- problem & baseline – where money leaks today;

- KPIs & targets – 2-3 metrics tied to dollars (e.g., detention $/load, OTD %, fuel/100 km);

- data plan – sources, history length, labeling;

- approach – rules vs ML vs vision; model features you have now;

- deployment – edge/cloud, fail-safes, alert routing, who acts within how many minutes;

- integrations – TMS/WMS/telematics endpoints, security;

- risks & guardrails – privacy, explainability, SLA;

- 30-90-day schedule – weekly KPI readouts, go/no-go gates.

Outcome of the week: a scoped, defensible logistics pilot with data paths, control hooks, an accountable owner, and KPIs linked directly to cost, service, or risk-ready to implement next.

AIoT suitability self-assessment

Use this AIoT Suitability Self-Assessment to quickly gauge whether your organization is ready for an AIoT pilot. Download the checklist to score your current state and identify gaps before investing.

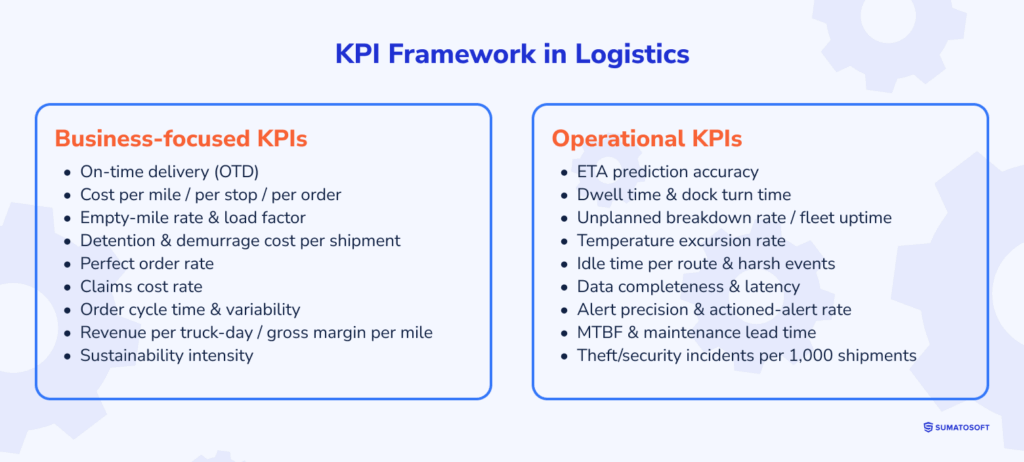

KPI Framework in Logistics

KPIs are the benchmarks that help logistics leaders navigate successfully during the AIoT implementation.

The right KPIs make the impact of implementing such a system visible: they show whether AIoT is cutting costs, lifting service quality, and creating resilience across the chain. These are the numbers executives track in board reports and operations teams watch daily dashboards for.

Business-Focused KPIs

- on-time delivery (OTD, by SLA tier) – share of deliveries that meet the promise. AIoT moves it via live telematics, ETA ML, and dynamic re-routing. Typical lift: +3-7 pts;

- cost per mile / per stop / per order – unit cost to move a shipment. AIoT: route optimization, idle reduction, predictive maintenance. Typical impact: −$0.20-$0.40/mi at scale;

- empty-mile rate & load factor (trailer utilization) – percent of non-revenue miles and average fill. AIoT: load-matching + real-time asset visibility. Typical impact: empties −8-15%; utilization 70%=>85%+;

- detention & demurrage cost per shipment – fees from waiting at docks/ports. AIoT: precise ETA, yard beacons, dock slot optimization. Typical impact: −15-30%;

- perfect order rate (OTIF, damage-free, correct docs) – the “no-excuses” metric. AIoT: ePOD, scan compliance, CV damage checks. Typical impact: ~90%=>98%+;

- claims cost rate ($ claims / $ shipped) – loss, damage, shortage. AIoT: shock/tilt/temp sensors, chain-of-custody analytics. Typical impact: −30-50%;

- order cycle time & variability – order=>delivery days, plus spread. AIoT: end-to-end tracking and handoff forecasting. Typical impact: −10-25% and tighter spread;

- revenue per truck-day / gross margin per mile – asset productivity and profit density. AIoT: higher utilization, fewer breakdowns, better routing. Typical impact: +5-12%;

- sustainability intensity (CO₂e per shipment / per mile) – emissions per move. AIoT: fewer empty miles, smoother driving, consolidation. Typical impact: −10-20%.

Operational KPIs

- ETA prediction accuracy (±15/±30 min) – reliability of promises. AIoT: multimodal ETA models (telematics, traffic, weather, lane history). Typical lift: ~30%=>80%+ within window;

- dwell time (yard/terminal) & dock turn time – minutes trucks sit and how fast docks cycle. AIoT: geofences, yard beacons, dock-occupancy CV, slotting. Typical impact: −15-30%;

- unplanned breakdown rate / fleet uptime – roadside failures vs. availability. AIoT: vibration/oil/tire telemetry + PdM models. Typical impact: failures −50-70%;

- temperature excursion rate (cold chain) – % loads or minutes out of spec. AIoT: continuous probes, anomaly detection, auto-alerts. Impact: sharp drop in excursions/spoilage;

- idle time per route & harsh events – wasted fuel and safety risk. AIoT: driver-behavior analytics from CAN/OBD. Typical impact: fuel −5-12%; fewer harsh events;

- data completeness & latency – % messages received and end-to-end delay. AIoT: multi-network SIMs, store-and-forward, QoS. Targets: >99% completeness, sub-minute latency for routing;

- alert precision & actioned-alert rate – signal quality and operator uptake. AIoT: calibrated thresholds, workflow integration (TMS/WMS/CMMS). Targets: high precision, >80% action within SLA;

- mean time between failures (MTBF) & maintenance lead time – resilience and readiness. AIoT: early part-needs forecasts, smarter shop scheduling. Impact: MTBF up, lead times down;

- theft/security incidents per 1,000 shipments – loss exposure. AIoT: geofences, tamper sensors, route-deviation alerts. Impact: measurable incident reduction.

Calculating Cost vs. Benefit (With an Example)

Next, we work with an example that allows you you to turn your detention, chargebacks, idle fuel, and overtime into clear $/stop, payback, and an operator-ready pilot plan you can approve confidently.

Use case: a regional grocery carrier used an AI ETA and appointment optimizer to resequence stops, reducing detention, chargebacks, idle time, and overtime while improving on-time delivery.

Step 1: Define Variables & Targets

| Metric | Symbol | Unit | Inputs (with units) | Financial benefit (formula) |

|---|---|---|---|---|

| Detention fees saved | $/year |

Hdet_saved = detention hours avoided (hours/year); Cdet = detention rate ($/hour) |

||

| Late penalties avoided | $/year |

Nlate_avoided = late deliveries avoided (stops/year); Cpenalty = penalty per late stop ($/stop) |

||

| Idle fuel saved | $/year |

Tidle_saved = idle time avoided (hours/year); ridle_fuel = fuel burn at idle (L/hour or gal/hour); Pfuel = fuel price ($/L or $/gal) |

||

| Overtime reduced | $/year |

Hot_saved = overtime hours avoided (hours/year); Wot = loaded OT wage ($/hour) |

||

| Confidence factor after pilot | 0–1 (factor) | – | ||

| Recurring opex | $/year | – | ||

| One-time costs | $ (one-time) | – | ||

| Operator acceptance – ETA accuracy (P80 within ±15 min by week 6) | % of stops | ETApred, ETAactual | Gate: pass if ≥80% by week 6 (supports P$, D$) | |

| Operator acceptance – median dwell reduction (by week 8) | % |

Dwellbaseline (min), Dwellpilot (min), Stopsyear |

Gate: pass if −20% by week 8; maps to D$ via Hdet_saved | |

| Operator acceptance – billed hours/stop (by week 8) | hours/stop | H_billedbaseline_stop, H_billedpilot_stop, Stopsyear | Gate: pass if −0.25 h/stop; contributes to | |

| Operator acceptance – chargebacks on named retailers (by week 10) | % | Chargebacksbaseline (cases/year), Cchargeback ($/case) | Gate: pass if −40%; contributes to | |

| Operator acceptance – idle time per stop (by week 8) | min/stop |

Stopsyear, ridle_fuel, Pfuel |

Gate: pass if −6 min/stop; contributes to | |

| Safety/compliance – HOS neutrality | hours/driver/week | HOS logs (baseline vs pilot) | Gate: no increase vs baseline (required to proceed) |

Step 2: Write Down Equations & Preconditions

Operational preconditions (must-haves):

- control path – dispatcher can accept/modify resequencing when ETA slip >12 min; driver app confirms; dock scheduler edits slots via API with email fallback; reefer setpoint/fan nudges where allowed;

- data & integrations – telematics/ELD (GPS, idle, fuel), TMS (orders/stops/penalties), WMS/YMS (doors/trailers), EDI 204/214/210;

- guardrails & runtime: driver privacy (PII 180-day retention), explainability for any scoring, union/site rules; ETA API SLO 99.5% and p95 <1.0 s with degraded-mode rules.

Step 3: Worked Example – ETA + Appointment Optimizer (Regional Retail Middle-Mile)

Scope: 120 tractors / 180 trailers; ~300 stops/day, 6 days/week; lanes into 3 DCs and ~150 stores.

Problems: late arrivals, detention, and chargebacks drive cost.

Inputs (annual):

- Ndel = 93,600

- detention: pdet = 18%, hdet = 1.1 h, cdet = $70/h, rD = 30%

- late: plate = 6%, cpen = $120, rP = 50%

- idle: midle = 8 min/stop, gphidle = 0.8, Pf = $4/gal

- overtime: Hot = 25 h/wk, W = $35/h

- α = 0.70

- O = $60,000

- K = $140,000

Results:

- D$=$389,189; P$=$336,960; F$=$39,936; L$=$45,500 => gross $811,585 => Benefits (α) $568,109.

- Net₁ = $568,109 − $60,000 = $508,109; Payback ≈ 0.28 yrs (~3.3 months); NPV (4 yrs, 10%) ≈ +$1.47M.

- Unit view: ≈ $5.43/stop or 6.8¢/mile if 7.5M miles/yr.

Additional results:

- acceptance check (time-boxed) – W6 ETA P80 ±15 min on DC-3 lanes; W8 dwell −20% and −0.25 h billed/stop; W10 chargebacks −40% on R1/R2; W8 idle −6 min/stop; no HOS uptick;

- exceptions (sample) – GPS dropout >10 min => dead-reckoning + human confirm; hard slot caps => propose cross-dock/two-leg; reefer alarm at gate => priority door or CSR negotiation with audit;

- change mgmt & support – two 45-min dispatcher trainings; 15-min driver brief; SOP “ETA slip >12 min => action”; scoring advisory only; PII 180 days; support 06:00-22:00, 7/7; Sev-1 ≤15 min;

- sensitivity – conservative (lower incidence/reduction, α=0.6, O=$80k, K=$180k) => Net₁ ≈ $141k, Payback ≈ 1.28 yrs, 4-yr NPV ≈ +$267k. Upside: higher penalties/peaks => payback ~2-3 months;

Use this example as a worksheet – swap your stops, penalties, detention, fuel, wages, and miles. Equations stay; inputs change. Adjust figures to match your actual baselines.

What’s Next?

Take one lane or site, appoint an owner, and commit to moving 2-3 KPIs (OTD, dwell, empty miles, cost per stop) in a 60-90-day pilot. Use the data you already have (GPS/ELD, TMS/WMS, reefer telemetry) to drive a few clear decisions-reroutes, dock reassignments, temperature corrections- and track the cash impact. If the pilot meets your payback bar and the team actually uses it, scale; if not, keep the data plumbing and cut the rest.

If you plan to develop your own AIoT logistics system, we encourage you to contact us at SumatoSoft. We are one of the top IoT development companies specializing in building custom Internet of Things networks for the logistics industry, and can help you.

How We Can Help

We design and ship custom logistics software that moves the numbers you care about-on-time delivery, cost per mile, dwell, utilization, and claims.

What we build:

- transportation and freight platforms (TMS, order-to-cash, tendering);

- fleet management with GPS/ELD/telematics and maintenance;

- yard and dock flows;

- ETA engines;

- control-tower visibility;

- and product-integrity monitoring.

We also re-engineer legacy apps and make integrations stick with 3PLs, WMS/ERP/OMS, and ELD providers. We provide custom Internet of Things development services and IoT consulting services on topics like device connectivity, data ingestion pipelines, cloud and edge architectures, AI/ML integration, security and compliance, and ROI-driven pilot design.

Delivery you can plan around:

- discovery mapped to KPIs;

- UX for dispatch, driver, and CS;

- disciplined engineering with CI/CD;

- QA with load and failover tests;

- integrations we own end-to-end;

- support with SLAs.

Agile, transparent, biweekly demos. In 95% of cases, we start the next business day; a scoped MVP typically lands in ~6 months.

Send us your top two pains-say ETA misses and dwell at DC-2. We’ll sign an NDA and return in one business day with an outline: scope, integrations, and a 60-90-day pilot plan. Let’s turn your KPIs into shipped software.

Let’s start

If you have any questions, email us info@sumatosoft.com