Top Healthcare Software Development Companies for HIPAA & FHIR Projects

With hundreds of vendors claiming compliance and experience, how do you find a team that actually understands healthcare software development?

In this article, we’ve done the hard part for you.

We analyzed companies based on what matters most:

- real experience in building regulated healthcare products;

- readiness to meet HIPAA, GDPR, and FHIR standards;

- tech stack compatibility with leading EHRs and health APIs;

- involvement of clinicians and medical experts;

- security practices and incident response maturity;

- specialized skills like AI for imaging, digital twins, or clinical trials.

This is not just a list. It’s a structured comparison – with use cases, certifications, pricing insights, and a downloadable checklist – to help you make a confident decision.

Let’s begin with the market context.

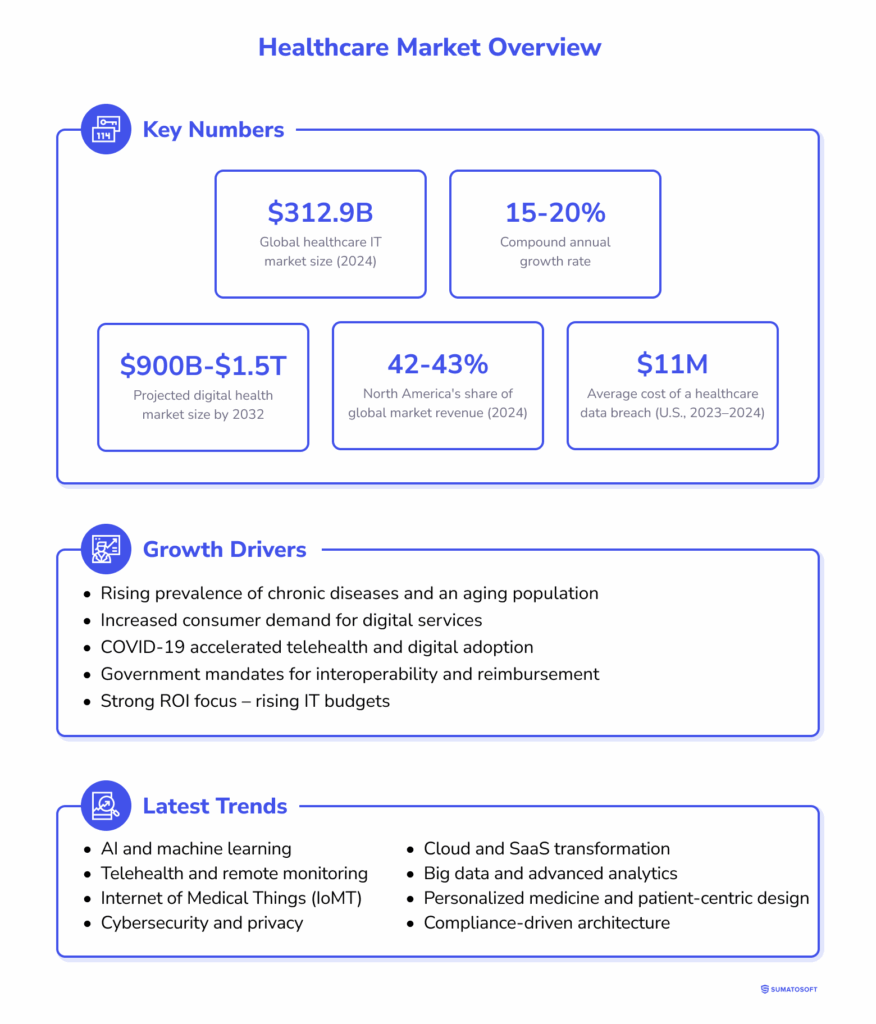

Healthcare Market Overview

Healthcare software development is one of the fastest-growing segments within the broader health IT and digital health sectors. In 2024, Fortune Business estimated the global healthcare IT market at around $312.9 billion, while the wider digital health segment reached approximately $376.7 billion.

The market is growing at a 15–20% compound annual rate, with projections suggesting it will surpass $900 billion – and potentially hit $1.5 trillion – by 2032. Clinical software is the largest and fastest-growing segment, with high demand for EHR systems and telehealth platforms.

North America leads the global market, generating about 42–43% of total revenues in 2024. Europe ranks second, while Asia-Pacific is expanding quickly as regional providers modernize and adopt digital health infrastructure.

Growth Drivers

Key factors behind the surge in custom software development include:

- rising prevalence of chronic diseases and an aging population;

- increased consumer demand for digital services;

- COVID-19, which dramatically accelerated software adoption – telehealth usage alone jumped from single digits to over 40% of U.S. outpatient visits during lockdowns;

- government mandates for interoperability, electronic records, and telemedicine reimbursement;

- strong focus on ROI – with 75% of healthcare providers and payers increasing IT budgets in 2024, especially for software that improves outcomes and reduces administrative load.

In short, healthcare organizations are investing heavily in software – not just to digitize, but to improve care quality, efficiency, and resilience. The shift from static systems to flexible, secure, and custom-built platforms is well underway.

Latest Trends

The healthcare software development landscape is evolving rapidly. Several technology and healthcare industry trends are shaping what software gets built – and how.

AI and Machine Learning

AI has become central to healthcare software. It’s used in diagnostics (e.g. image analysis), predictive analytics, personalized treatment planning, and administrative tasks like automated note transcription or fraud detection. Generative AI is also being piloted for triage chatbots and clinical documentation.

The healthcare AI market is projected to grow to $164 billion by 2030. Despite regulatory and validation hurdles, AI’s ability to automate tasks and support decisions makes it one of the strongest drivers of innovation today.

Telehealth and Remote Monitoring

Telehealth became mainstream after the pandemic. In the U.S., usage jumped from single-digit levels to over 40% of outpatient visits during lockdowns. By 2026, the global market is expected to reach $175–500 billion, depending on the scope of virtual care included.

Software developers are now focused on improving video visit workflows, integrating remote patient monitoring (RPM) data into EHRs, and creating seamless user experiences.

Internet of Medical Things (IoMT)

Wearables, smart devices, and connected sensors form the backbone of modern remote care. The IoMT market is expected to grow from under $100 billion in the 2010s to about $814 billion by 2032.

Custom software must now handle real-time data from multiple sources, ensure interoperability via standards like HL7/FHIR, and trigger alerts or feed analytics dashboards. This shift also puts pressure on teams to design for privacy and reliability.

Cybersecurity and Privacy

Healthcare remains the most targeted industry for cyberattacks, with an average breach cost of $11 million in the U.S. (2023–2024). A major 2024 attack on Change Healthcare disrupted claims processing for providers nationwide.

Software is now expected to follow “security-by-design” principles: encryption, MFA, monitoring, and HIPAA/GDPR compliance are baseline requirements. Interest in blockchain for tamper-proof health data is growing, with projections of a $500 billion market by 2031 if adoption continues.

Cloud and SaaS Transformation

Hospitals are replacing on-premise systems with cloud-hosted applications. The healthcare cloud market is projected to reach $120.6 billion by 2029, and the SaaS segment alone could grow from $34.8 billion in 2024 to $94.6 billion by 2034.

Cloud platforms offer scalability, interoperability, and lower IT overhead. Most new solutions – whether portals or AI engines – are delivered as SaaS, often with hybrid models for sensitive deployments.

Big Data and Advanced Analytics

Healthcare data – from EHRs, wearables, genomics, and claims - is exploding in volume. The big data analytics market is expected to hit $327.5 billion by 2034.

Software tools now prioritize predictive modeling, population health analysis, and value-based care optimization. FHIR APIs and other interoperability standards are critical for unifying disparate datasets.

Personalized Medicine and Patient-Centric Design

The healthcare industry now uses custom platforms to create individualized care plans through analysis of patient records and behavioral patterns and genomic data. According to Statista, the personalized medicine market achieved $655 billion in 2024 and analysts predict it will surpass $1.1 trillion by 2030.

There’s also a UX shift: health software must now prioritize ease of use and patient engagement – not just administrative efficiency.

Compliance-Driven Architecture

Regulations are evolving quickly. In the U.S., the 21st Century Cures Act mandates API-based data sharing. In the EU, MDR affects how digital therapeutics and software as medical devices (SaMD) are classified and cleared.

Software teams must now build with auditability, interoperability, and international compliance in mind – often from the first line of code.

These trends show a clear direction: toward intelligent, secure, patient-centered, and cloud-based systems. Healthcare providers are no longer asking if they need software – but how soon they can launch solutions that align with these priorities.

How the Market Evolved

To understand the 2025 healthcare software development market, it helps to trace its evolution – particularly from the late 2010s and early 2020s. Three major shifts have shaped the current landscape.

1. COVID-19: From Experimental to Essential

Telehealth and digital tools were gradually increasing their presence in healthcare systems before 2020 but most organizations treated them as experimental programs. The pandemic brought about a sudden transformation in healthcare systems.

The COVID-19 pandemic reached its peak when telehealth services became the primary choice for outpatient care reaching more than 40% of all visits in the United States. Healthcare facilities quickly deployed new EHR systems and patient portals to enable remote healthcare services and patient participation.

Virtual visits maintained their elevated numbers after the pandemic but they stayed higher than pre-2020 levels. The telehealth market will experience a fourfold growth from 2019 to 2026 because it represents a lasting transformation of healthcare structures.

Remote care software along with digital triage tools and online scheduling platforms have evolved from innovative tools to essential infrastructure in modern healthcare. Healthcare providers continue to optimize their pandemic-era investments by concentrating on return on investment and system integration.

2. Funding: From Hype to Maturity

In 2021, digital health startups raised $29 billion in the U.S. alone – a record. This led to a spike in valuations, rapid hiring, and an influx of new products. But by 2022–2023, rising interest rates and market corrections halved funding levels.

Some startups failed to survive this shift, especially those lacking a reimbursement path or clinical validation. At the same time, private equity firms began acquiring undervalued players, such as R1 RCM’s $8.9 billion deal in 2023.

By 2025, the market had rebounded. Public digital health stocks rose ~12% over 12 months, and private company valuations returned to near-peak levels. But the focus has changed – Clients and investors now demand real-world outcomes, regulatory clearance, and sustainable business models.

This benefits Clients: development companies that survived are more likely to be stable, long-term partners with a proven track record – not just fast-growth ventures chasing the next funding round.

3. Tech Stack: From EHR Rollouts to Platform Thinking

In the mid-2010s, software projects often centered around digitizing paper records and installing EHRs – frequently hosted on-premise, lacking APIs, and frustrating for clinicians.

The industry now focuses on cloud-based platforms and modular architectures and FHIR-compatible systems which enable open data exchange. The core systems integrate specialized applications which include chatbots and AI diagnostics and remote monitoring dashboards.

FDA-approved AI diagnostic tools are no longer rare. As of 2025:

- over 360 digital therapeutic products are available (140 prescription-grade);

- more than 100 AI-driven diagnostic tools are already in use.

On the patient side, adoption of wearables and health apps has grown rapidly. Consumers are now more comfortable tracking their own health, pushing providers to support connected experiences.

Compared to 2019, today’s market is bigger, smarter, and more stable. What used to be innovation is now infrastructure – and software development providers are expected to bring deep experience, compliance awareness, and clear ROI to every new engagement.

Market Pricing: Is Healthcare Software Development Overpriced or Underpriced?

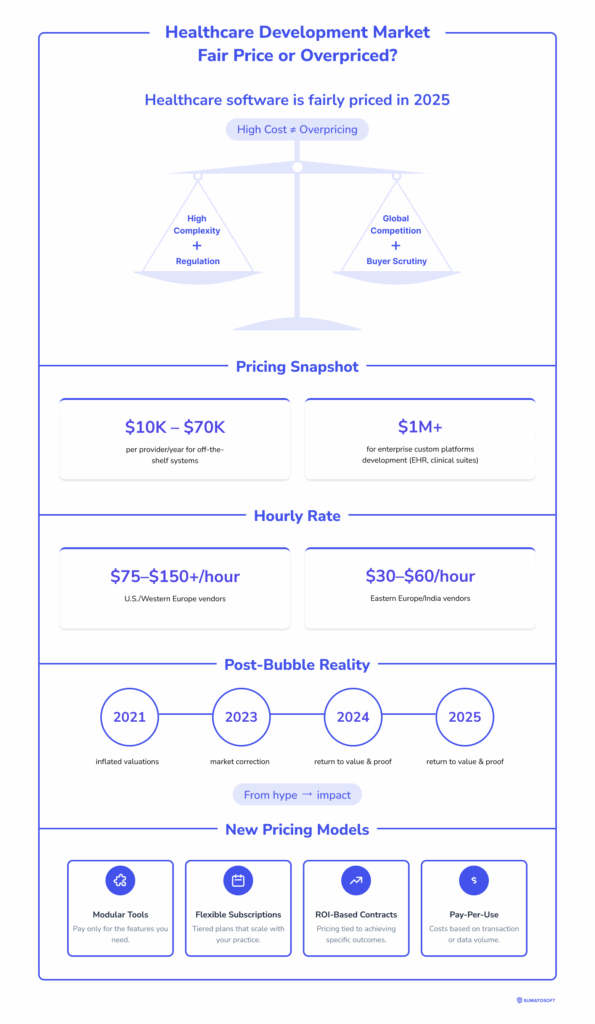

Healthcare software development is fairly priced in 2025, with high costs reflecting the complexity and regulatory demands, yet balanced by strong global competition and growing client scrutiny.

Is healthcare software development worth what it costs? The answer depends on what you’re buying – and who’s building it.

High Cost, but Often High Value

Custom healthcare software, especially enterprise-level platforms, can be expensive. Some hospitals have paid tens or even hundreds of millions for full EHR implementations. Even licensing fees for off-the-shelf systems can run from $10,000 to $70,000 per provider per year, depending on features.

At first glance, this seems excessive. But many organizations accept the price because the return on investment (ROI) is clear. A $1 million software system that prevents costly medical errors or reduces staffing inefficiencies can save multiples of its cost each year.

Executives recognize this: 96% of healthcare leaders believe investing in tech is essential to controlling costs and improving quality – even if 70% haven’t yet seen short-term savings. The emphasis today is on software that delivers measurable results: reducing readmissions, optimizing workflows, or improving billing. If a product doesn’t show ROI, it’s now unlikely to survive procurement scrutiny.

A Global, Competitive Market

The pricing landscape is shaped by global competition. While top-tier vendors in the U.S. or Western Europe might charge $75–$150+ per hour, highly capable teams in Eastern Europe or India often provide comparable quality at $30–$60/hour.

This competition puts downward pressure on costs and gives Clients leverage. Development services are not monopolized – there are undervalued but highly capable vendors globally.

Still, healthcare isn’t a field where you can cut corners. Expertise in HIPAA, HL7/FHIR, and medical workflows commands a premium – for good reason. Poorly developed software risks compliance violations or clinical errors. The market rewards proven experience.

In this sense, the industry is pricing itself rationally: basic development is cost-efficient, while high-stakes, high-complexity work is priced accordingly.

Post-Bubble Valuations Create New Opportunities

During the 2021 funding surge, many digital health companies were arguably overvalued. By 2023, a correction brought down those valuations, opening up M&A opportunities. Some firms were taken private at deep discounts.

Now valuations are recovering – but buyers are more cautious. Clients and investors alike expect proof of impact, not promises.

This change has influenced pricing models. Vendors, pressured to justify costs, are shifting toward modular tools, flexible subscriptions, and value-based pricing (e.g. pay-per-use or ROI-based contracts). The result: more transparent pricing and better alignment with outcomes.

Bottom Line: The Market Is Maturing

Today, healthcare software development isn’t cheap – but it’s rarely overpriced for what it offers. Thanks to competition, offshore talent, and cloud infrastructure, it’s often more cost-efficient than in the past.

Some niches – like AI diagnostics or regulated clinical systems – require high investment. But there are also undervalued opportunities with skilled teams in emerging markets or through open-source solutions.

Overall, the pricing reflects a shift from hype to value. Hospitals are still increasing IT spend, even under financial pressure, which tells us they see software not as a cost center, but as a strategic investment.

Healthcare Software Development Cost by Type and Region

| Software type | Region | Development cost (USD) | Timeline (months) | Annual maintenance (% of dev cost) |

|---|---|---|---|---|

| EHR module (basic) | USA | $540,000 – $1.3M | 9–14 | 19–23% |

| Central Europe | $330,000 – $780,000 | 8–12 | 16–19% | |

| Eastern Europe | $200,000 – $480,000 | 8–11 | 13–18% | |

| India | $95,000 – $235,000 | 6–10 | 10–14% | |

| Asia (ex. IN) | $120,000 – $300,000 | 7–11 | 12–17% | |

| Telehealth platform | USA | $370,000 – $1.05M | 6–10 | 17–22% |

| Central Europe | $230,000 – $650,000 | 5–9 | 14–17% | |

| Eastern Europe | $160,000 – $370,000 | 5–8 | 11–15% | |

| India | $85,000 – $195,000 | 4–7 | 10–13% | |

| Asia (ex. IN) | $110,000 – $215,000 | 4–8 | 12–15% | |

| AI diagnostic tool | USA | $760,000 – $2.3M | 10–16 | 22–28% |

| Central Europe | $480,000 – $1.6M | 9–14 | 17–23% | |

| Eastern Europe | $300,000 – $1.1M | 9–13 | 15–19% | |

| India | $160,000 – $540,000 | 8–12 | 13–17% | |

| Asia (ex. IN) | $190,000 – $620,000 | 8–12 | 15–19% | |

| Remote monitoring app | USA | $370,000 – $980,000 | 6–10 | 19–22% |

| Central Europe | $240,000 – $580,000 | 5–9 | 14–20% | |

| Eastern Europe | $150,000 – $430,000 | 5–8 | 13–15% | |

| India | $80,000 – $190,000 | 4–7 | 10–13% | |

| Asia (ex. IN) | $95,000 – $215,000 | 4–7 | 12–16% | |

| Medical billing system | USA | $280,000 – $880,000 | 5–8 | 17–21% |

| Central Europe | $190,000 – $470,000 | 5–8 | 14–17% | |

| Eastern Europe | $120,000 – $320,000 | 4–7 | 12–14% | |

| India | $65,000 – $170,000 | 4–6 | 10–13% | |

| Asia (ex. IN) | $75,000 – $195,000 | 4–7 | 12–14% |

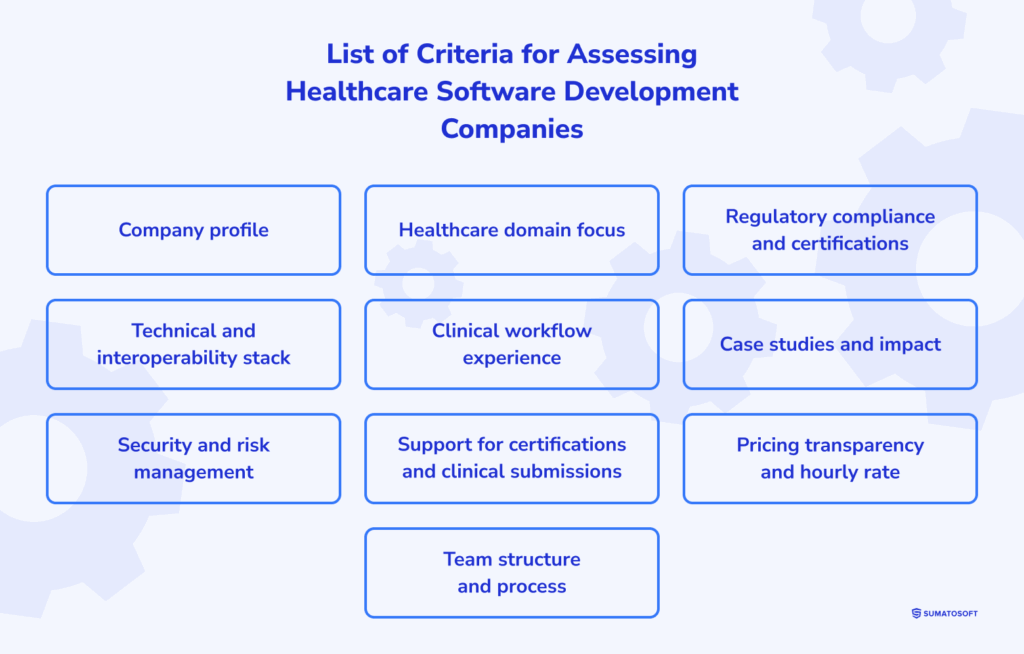

An Ultimate List of Criteria for Assessing Healthcare Software Development Companies

In this section, we break down the specific criteria we used to assess each company. These criteria go beyond general IT capabilities and focus on what truly matters in the healthcare space: regulatory expertise (HIPAA, GDPR, FDA, MDR), real-world clinical workflow experience, modern tech stacks (FHIR, HL7, SMART, Kafka), and proven ability to handle security risks and compliance audits.

Each criterion is clarified with what to check and why it matters. Below, there is the criteria list.

#1. Company profile

What to check:

- founding year;

- number of employees (global + healthcare-focused);

- headquarters and delivery centers.

Why it matters:

Shows stability, scalability, and healthcare project readiness.

#2. Healthcare domain focus

What to check:

- healthcare specializations: EHR, telemedicine, diagnostics, imaging AI, oncology, mental health, clinical trials;

- advanced tech: genomics, digital twins, ambient voice, healthcare IoT devices, generative AI.

Why it matters:

Many vendors say they do “healthcare” but lack vertical specialization.

#3. Regulatory compliance and certifications

What to check:

- HIPAA (USA), GDPR (EU), MDR (EU), FDA (US SaMD) familiarity;

- ISO 13485 – medical device software QMS;

- ISO 27001 – information security;

- SOC 2 Type II – cloud data protection;

- HL7 membership or affiliations;

- staff HIPAA training and audit readiness.

Why it matters:

Healthcare software must meet both global and local laws.

#4. Technical and interoperability stack

What to check:

- interoperability standards: FHIR, HL7 v2/v3, DICOM, LOINC, SNOMED, ICD-10, X12;

- authentication protocols: OAuth2, OpenID Connect;

- integration platforms: Epic App Orchard, Cerner Code;

- backend: Python, Node.js, Ruby, Kafka/RabbitMQ;

- open-source or modular stack preference.

Why it matters:

Tech decisions impact future-proofing, integration, and cost.

#5. Clinical workflow experience

What to check:

- collaboration with clinicians during design;

- experience with SOAP notes, CPT codes, EHR toggling;

- UX for cognitive load reduction;

- alert logic, decision trees, workflow interrupt handling.

Why it matters:

Apps must fit real clinical behavior – not just software best practices.

#6. Case studies and impact

What to check:

- 2–3 detailed case studies with metrics (e.g. 30% faster charting, 20% fewer readmissions);

- Clients in similar domains (e.g. telehealth for oncology, not general care);

- testimonials or public references.

Why it matters:

Real-world proof beats website claims.

# 7. Security and risk management

What to check:

- RBAC, MFA, audit trails;

- penetration testing results;

- incident response process (SIEM use, DevSecOps pipelines);

- real example of a past security incident and actions taken.

Why it matters:

Security is not about being flawless – it’s about response maturity.

#8. Support for certifications and clinical submissions

What to check:

- familiarity with FDA SaMD, EU MDR, HIPAA audits;

- checklists, templates, or QA support for submissions;

- clinical evidence support (for AI/diagnostic tools).

Why it matters:

If you need clearance for your app or device, the vendor must know how to support it.

#9. Pricing transparency and hourly rate

What to check:

- hourly rates by role (developer, PM, BA, QA, UX/UI);

- fixed-price vs. T&M options;

- post-launch maintenance terms.

Why it matters:

Cost-efficiency varies wildly by region and expertise.

#10. Team structure and process

What to check:

- healthcare-trained PMs and BAs;

- UX/UI design process with clinical input;

- DevOps readiness: CI/CD, test automation, cloud deployment;

- agile or hybrid delivery methodology.

Why it matters:

Healthcare software requires tight alignment of development, compliance, and clinical stakeholders.

Healthcare Software Vendor Evaluation Checklist: Choose With Confidence

The healthcare vendor evaluation checklist.

Healthcare software development partner selection requires more than cost and timeline estimations, because such a collaboration demands trust alongside expertise in regulatory compliance and dealing with clinical operations. The checklist enables you to evaluate vendors based on factors that truly matter.

This checklist serves as a tool for RFP processes and technical interviews and procurement reviews to verify your partner possesses both necessary credentials and clinical understanding for developing safe reliable scalable healthcare software.

Quick Comparison of Leading Healthcare Software Vendors

| Rank | Company | HQ & Delivery Centers | Team Size & Rate | Best For | Tech & Compliance Highlights |

|---|---|---|---|---|---|

| #1 | SumatoSoft | Boston, USA; Poland, Ukraine (possible) | 50–249, $50–$99/hr | Custom EHR/EMR, telemedicine, IoT monitoring | Java, Node.js, RoR, React; HIPAA, GDPR, FHIR, ISO |

| #2 | Andersen | Warsaw, Poland; 17 global offices | 3,500+, $60–$120/hr | EHR/EMR, RPM, patient portals, AI clinical systems | Java, .NET, React, AWS; HIPAA, GDPR, ISO 13485 |

| #3 | ScienceSoft | McKinney, USA; Europe, ME | 750+, $60–$120/hr | Telehealth, HIE, AI, IoMT | .NET, Python, React; HIPAA, SOC, FHIR, ISO 27001 |

| #4 | Innowise Group | Warsaw, Poland; USA, UAE | 2,500+, $60–$120/hr | Diagnostics, HIE, imaging, modernization | Java, .NET, Python; HIPAA, GDPR, HL7, ISO 27001 |

| #5 | Orangesoft | San Francisco, California | 100+, $50–$99/hr | Compliance-ready mHealth applications, telemedicine and RPM solutions | Java, .NET, C++, Python, Node.js, React.js, Kotlin, Flutter, React Native |

| #6 | Relevant Software | New York, USA; Poland, Ukraine, Spain | 11–50, $60–$100/hr | Custom systems, population analytics, team extension | JS, Python, React; HIPAA, FHIR, HL7 |

| #7 | BairesDev | San Francisco, USA; LATAM | 4,000+, $60–$120/hr | Scalable EHR/telehealth, QA, Epic Connect | JS, React, .NET; HIPAA, Epic standards |

| #8 | Empeek | Texas, USA (remote-first) | 51–200, $25–$49/hr | Predictive tools, EHR, RCM, IoT | Node.js, Python, React; HIPAA, DICOM, ISO 27001 |

| #9 | Langate | New York, USA; Ukraine | 50–200, $50–$99/hr | SaaS platforms, BI, EHR integrations | .NET, Azure, HL7, FHIR; HIPAA, Microsoft Gold |

| #10 | Kanda Software | Newton, USA; EU & LATAM teams | 200–500, $60–$120/hr | Life sciences, ADR tools, precision medicine | AWS, .NET, React; HIPAA, HITRUST, FHIR, FDA |

Top Healthcare Software Development Providers

#1 SumatoSoft

Founded: 2012

Headquarters: Boston, USA

Delivery centers: Poland (Warsaw), possibly Ukraine

Team size: 50-249

Hourly rate: $50-$99

Best for: Custom EHR/EMR, telemedicine and healthcare IoT development

Core healthcare specialties

SumatoSoft delivers full-cycle digital health solutions – from EMR/EHR and practice/lab/asset management platforms to telehealth and mHealth apps. They specialize in healthcare IoT, the intersection of IoT and Big Data, and big data development services (e.g., remote monitoring, glucose and HRV tracking apps), AI analytics, device-to-cloud integrations, and secure telemedicine tools.

Certifications & compliance

ISO 27001, ISO 9001, HIPAA, GDPR, FHIR, HL7, DICOM, FDA, HITECH, SSAE/SOC, IEC 62443.

Experience with clinicians

They integrate indirectly via Client-provided clinical specifications; no notable direct clinician co-development reported.

Healthcare tech stack

Java, Node.js, Ruby on Rails, React.js, Big Data, AI/ML, blockchain – strong for both web development and mobile healthcare platforms.

Standards for data exchange

FHIR, HL7, DICOM, ICD-10 (and LOINC/SNOMED via HL7/FHIR support).

Recent case study

- Medical transportation platform – staff augmentation and feature enhancements (COVID-trip types, route optimization, scalable refactoring) for a U.S./UK medical transport provider operating in 26 states – 12-person team over 10 months.

- Glucose monitoring app – developed a diabetes self-care app for tracking and visualizing blood sugar levels.

- HRV monitoring platform – built stress and heart rate variability real-time biofeedback tool.

Security maturity

Mobile and web healthcare apps secured with encryption at rest/in transit, HIPAA-/GDPR-compliant DevSecOps, and robust QA/auditing processes.

Working with SumatoSoft has been an outstanding experience.

Their team is not only highly skilled but also incredibly responsive, collaborative, and committed to delivering quality results. I can’t recommend them enough! Thank you team SumatoSoft for bringing my vision to life.

#2 Andersen

Founded: 2007

Headquarters: Warsaw, Poland

Delivery centers: Poland, Germany, USA, UK, Lithuania, Hungary, Kazakhstan, Georgia, Azerbaijan, Cyprus, UAE, Ireland, Germany, Czech (approximately 17 dev offices globally)

Team size: 3,500+

Hourly rate: $60-$120 (based on industry norms)

Best for: Custom EHR/EMR, telehealth and RPM, patient portals, AI-assisted clinical systems.

Core Healthcare Specialties

Andersen specializes in end-to-end digital health products – custom EHRs/EMRs, patient portals, telemedicine solutions, remote patient monitoring (RPM), and AI-powered clinical decision support systems. They emphasize usability to minimize medical errors, integrate with wearables and external systems (LIS, RIS, RCM), and build digital therapeutics and SaaS medical platforms.

Certifications and Compliance

HIPAA, GDPR, ISO 13485, ISO 9001, ISO 27001.

Experience With Clinicians

Supported by an internal healthcare advisory board of 30+ clinicians, researchers, and life-science experts across Europe and North America.

Healthcare Tech Stack

Java, .NET (C#), Node.js, Python, React, AWS/Azure, IoMT, API integration, DevOps and QA automation.

Standards for Data Exchange

FHIR, HL7 v2/v3, DICOM; also integrates with LIS, RIS, RCM systems.

Recent case study

- Digital RPM platform – built custom remote patient monitoring with wearables integration and telehealth front end (implied from service offering in patient portals and RPM).

- EHR/EMR and patient portal – delivered compliant EMR/EHR solutions and patient-facing portals with secure data exchange and usability focus.

- AI-enabled clinical system – developed clinical decision tools and AI pipelines in consultations with in-house clinical board (services highlight).

Security maturity

Employs HIPAA-/GDPR-compliant DevSecOps, encryption at rest and in transit, SOC/ISO-standard auditing, penetration testing, and robust incident response.

#3 ScienceSoft

Founded: 1989

Headquarters: McKinney, USA

Delivery centers: USA, Mexico, UAE, KSA, Finland, Latvia, Lithuania, Poland (Warsaw)

Team size: 750+

Hourly rate: $60-$120

Best for: HIPAA-ready EHR/HIE, telehealth, IoMT integrations, AI-powered healthcare systems

Core healthcare specialties

ScienceSoft has delivered a full spectrum of healthcare solutions: EHR/EMR and HIE systems; telemedicine platforms including provider-to-provider and patient-facing apps; remote patient monitoring using IoMT; AI-driven tools (speech recognition, chatbots, voice assistants); cloud migration; clinical analytics; and digital therapeutics. They recently created a HIPAA-compliant telehealth management solution on Microsoft Cloud and developed a real-time AI voice-scheduling assistant using Amazon Nova Sonic and FHIR APIs.

Certifications and compliance

ISO 13485, ISO 9001, ISO 27001, HIPAA, GDPR, FDA/MDR, SOC 1/2/3, HL7/FHIR, ICD-10, XDS, HITECH.

Experience with clinicians

They embed clinical SMEs and healthcare compliance consultants and often partner directly with clinicians and providers in system development.

Healthcare tech stack

Java, .NET (C#), Python, Node.js, React.js, MS SQL Server, MongoDB, AWS/Azure, Microsoft Power Platform, FHIR/HL7 integration tech.

Standards for data exchange

FHIR, HL7 v2/v3, DICOM, XDS, ICD-10, LOINC.

Recent case study

- Provider-to-provider behavioral telehealth platform – HIPAA-compliant Microsoft Cloud system integrating with Epic/Cerner, streamlining workflows and reducing coordination time by ~40%.

- AI voice scheduling assistant – real-time HIPAA-compliant speech-to-speech agent using Amazon Nova Sonic and LiveKit, reducing scheduling costs by ~50% and latency via FHIR APIs.

- HIE system + patient mobile app – secure PHI sharing across labs, pharmacies, and insurers using HL7, FHIR, XDS.b, with encrypted storage and state health dept certification

Security maturity

Implements ISO 27001-based DevSecOps with encryption in transit/at rest, role-based access control, SIEM/XDR tools, regular audits and penetration testing.

#4 Innowise Group

Founded: 2007

Headquarters: Warsaw, Poland

Delivery centers: Poland, Germany, USA, UAE, Lithuania, plus additional offices in Frankfurt, Batumi, UK

Team size: 2,500+ IT professionals

Hourly rate: $60-$120 (industry typical, estimated)

Best for: Custom EHR/HIE, AI-powered diagnostics and imaging, telehealth, legacy healthcare modernization.

Core healthcare specialties

Innowise provides end-to-end healthcare software services – from hospital and clinic management systems (HIS, EHR/EMR) and patient portals to AI-driven diagnostic tools, remote patient monitoring, digital therapeutics, clinical decision support, and medical imaging analysis. They also build lab info systems, health insurance management platforms, and integrate wearables – all delivered via full-stack, compliance-first engineering.

Certifications and compliance

ISO 13485, ISO 9001, ISO 27001, HIPAA, GDPR, FDA/MDR, OWASP, SOC 2.

Experience with clinicians

They engage clinicians through in-house medical doctors and consultants to guide requirements, especially in specialties like dermatology and ophthalmology.

Healthcare tech stack

Backend: Java, .NET (C#), Node.js, Python

Frontend: React.js, UI/UX design (Innowise Design Studio)

Databases and cloud: MS SQL, MongoDB, AWS, Azure

Advanced: Big data, AI/ML, blockchain, IoT/IoMT, VR/AR/3D medical visualization (VOKA.IO)

Standards for data exchange

FHIR, HL7 v2/v3, DICOM, XDS, ICD-10, CPT, LOINC.

Recent case study

- Radiation exposure monitoring app modernization – legacy app refactored for better infrastructure; database performs 1.5-3× faster, UI is 3.3× more responsive.

- Pharmacy inventory management overhaul – migrated to microservices architecture; throughput increased 30%, performance increased 40%.

- Lab management system optimization – CI/CD automation and DevOps modernization; compute cost reduced 70%, development speed doubled.

- Clinical data integration platform – built secure pipelines for clinical trials and genomic data, predictive modeling dashboards for pharma Client.

Security maturity

Follows HIPAA-/GDPR-compliant DevSecOps using encryption at rest and in transit, role-based access control, multi-layer authentication, regular security audits, and SIEM-based monitoring. Well-versed in preventing breaches via patching and access controls.

#5 Orangesoft

Founded: 2011

Headquarters: San Francisco, California

Delivery centers: USA, Poland

Team size: 100+

Hourly rate: $50–$99

Best for: Compliance-ready mHealth applications, telemedicine and RPM solutions, AI-based healthcare systems, and IoMT integrations.

Core healthcare specialties

Orangesoft’s strength lies in delivering custom web and mobile software solutions that are secure, scalable, and fully compliant with healthcare regulations. Their expertise spans a full range of healthcare digital solutions, including remote patient monitoring, telemedicine apps, wellness applications, virtual care infrastructures, and more. Beyond proven tech stacks, Orangesoft applies conversational AI, ML, sentiment analysis, IoMT, AR/VR, and other advanced technologies to create innovative solutions with measurable clinical impact.

Certifications and compliance

ISO 13485, ISO 9001, ISO 27001, HIPAA, GDPR, FDA/MDR, SOC 2.

Experience with clinicians

Clinicians, scientists, and expert advisory boards are engaged throughout the development process to ensure clinical accuracy and usability.

Healthcare tech stack

Java, .NET, C++, Python, Node.js, React.js, Kotlin, Flutter, React Native, Swift, SQLite, MySQL, PostgreSQL, MongoDB, AWS/Azure/Google Cloud Platform.

Standards for data exchange

FHIR, HL7 v2/v3, DICOM, XDS, ICD-10, LOINC.

Recent case study

- Remote patient monitoring system with telemedicine capabilities – an FDA-compliant suite of mobile and web-based applications supporting a post-stroke patient monitoring program, enabling effective care transition for 50,000+ patients.

- Virtual hospital platform – a HIPAA/FDA-compliant collaborative care platform, supplemented with AI for pathology and radiology imaging, which ultimately reduced report turnaround time by 82%.

- Custom AI clinical trial matching platform — an AI-powered platform for a U.S. biotech company, increasing treatment opportunities by 15%.

Security maturity

Backed by HIPAA and GDPR-compliant DevSecOps practices, including threat modeling, automated testing, vulnerability scanning, continuous monitoring, RBAC, end-to-end encryption, and comprehensive audit trails.

#6 Relevant Software

Founded: 2015

Headquarters: New York, USA

Delivery centers: Ukraine (Lviv), Poland (Warsaw), Spain (Valencia)

Team size: 11–50

Hourly rate: $60–$100

Best for: Custom healthcare software, HIPAA-compliant full-stack development, team extension services.

Core healthcare specialties

Relevant Software offers full-cycle healthcare software development – from strategy and consulting to deliverables and support. Their strength lies in building intuitive, custom systems such as EHR/EMR modules, population health analytics platforms, telehealth tools, IoMT integrations, and legacy system modernization. They emphasize AI, ML, and big data pipelines to deliver patient-centered platforms that boost clinical outcomes and operational efficiency.

Certifications and compliance

HIPAA, GDPR, ISO 27001 (implied via secure and compliant focus).

Experience with clinicians

Relies on Client-provided clinical specifications and EHR data. No clear direct clinician involvement reported.

Healthcare tech stack

JavaScript, Node.js, Python, Angular, React, MongoDB, MySQL, AWS, Azure.

Standards for data exchange

FHIR, HL7 integrations, EHR data ingestion and reporting-focused interoperability pipelines.

Recent case study

- Healthcare software modernization – upgraded legacy systems with UX enhancements and data migration to modern architectures.

- Custom population health analytics platform – ingested EHR data and implemented reporting dashboards that support community health centers.

- Telehealth and patient engagement solution – built secure messaging and appointment scheduling modules integrated with clinic workflows.

Security maturity

Delivers HIPAA- and GDPR-compliant DevSecOps practices. Includes encrypted data at rest and in transit, regular security audits, authentication and authorization controls, and ongoing support to maintain compliance.

#7 BairesDev

Founded: 2009

Headquarters: San Francisco, USA

Delivery centers: Latin America (Argentina, Brazil, Colombia, Mexico, etc.) – nearshore delivery via 4,000+ engineers across LATAM

Team size: ~4,000+ developers

Hourly rate: $60–$120

Best for: Rapid nearshore team scaling for HIPAA-compliant healthcare apps with AI/analytics, EHR integration, and telehealth platforms.

Core healthcare specialties

BairesDev develops custom healthcare platforms including EHR extensions, telehealth portals, population health analytics, IoT-enabled patient monitoring, workforce planning tools, and clinical research platforms. Notable Clients include IQVIA, Gennev, Acumen, and others. They enable scalable, secure digital health solutions through their nearshore engineering model.

Certifications and compliance

HIPAA- and GDPR-compliant architectures embedded in software development and delivery.

Experience with clinicians

Primarily relies on Client-provided clinical requirements. Offers QA and staff augmentation aligned with healthcare standards such as Epic accreditation support when needed.

Healthcare tech stack

JavaScript, Node.js, React, Python, Java, .NET, HL7/FHIR.

Standards for data exchange

FHIR and HL7-based integrations for EHR exchange, with capability to support Epic Connect workflows and broader interoperability via HL7 standards.

Recent case study

- Iqvia clinical research platform – senior React team improved SmartSolve components, enhancing scalability and compliance visibility over a 3-year engagement (NPS 9.67/10).

- Gennev telehealth platform – delivered failover infrastructure, CD pipeline, React/React Native + Node.js backend, boosting reliability and responsiveness (NPS 9.3/10).

- Acumen EHR QA & Epic Connect validation – five-year QA support culminating in Epic Connect accreditation (2022–2023), enhancing performance and compatibility for nephrology apps.

Security maturity

Integrates HIPAA and GDPR compliance into every release cycle with encrypted data at rest and in transit, secure DevOps pipelines, staging-production parity, regular testing, and QA aligned with healthcare platforms like Epic Connect.

#8 Empeek

Founded: 2015

Headquarters: Leander (Austin area), Texas, USA

Delivery centers: Remote-first development model; Clients globally, leveraging U.S.-based and offshore teams

Team size: 51–200

Hourly rate: $25–$49

Best for: Custom HIPAA-compliant healthcare systems, EHR/EMR, telemedicine, IoT, and predictive analytics.

Core healthcare specialties

Empeek delivers custom healthcare solutions including EMR/EHR systems, patient portals, telemedicine platforms, remote patient monitoring (IoT), healthcare CRM systems, and billing/RCM automation. They also build AI/ML-powered predictive tools and integrate with medical devices to support clinical workflows, patient engagement, and operational efficiency.

Certifications and compliance

HIPAA, HITECH, GDPR, HL7, FHIR, DICOM, ISO 27001:2022, ISO 9001:2015.

Experience with clinicians

No explicit evidence of embedded clinical staff. Relies on user-centered workflows shaped by healthcare partner input and domain consulting during discovery phases.

Healthcare tech stack

Node.js, React, Python, .NET, PostgreSQL, AWS, FHIR.

Standards for data exchange

FHIR, HL7 v2/v3, DICOM. Supports EHR/EMR integrations and HL7-based healthcare CRM systems.

Recent case study

- VelloHealth HIPAA-compliant scheduling/chat app – reduced no-shows by 50%, and boosted billing by 109% for ACT teams through mobile-first tools.

- Revive telehealth platform across 8 states – rescaled infrastructure to support 30+ clinics with Twilio MFA, enhancing security and throughput for behavioral healthcare.

- CRM platform supporting predictive analytics for patient outreach – implemented microservices-based patient lifecycle CRM using HL7 XML/EDI, enabling risk detection and segmentation.

Security maturity

Empeek enforces HIPAA and GDPR-compliant DevSecOps with encrypted PHI at rest and in transit, access control, SIEM-style audit logging, penetration testing, and coding standards best practices.

#9 Langate Software

Founded: 2001

Headquarters: New York, USA

Delivery centers: US and Ukraine (Kharkiv); supports U.S. healthcare and enterprise Clients

Team size: ~50–200

Hourly rate: $50–$99

Best for: HIPAA-compliant custom healthcare SaaS, EHR integrations, healthcare BI and analytics.

Core healthcare specialties

Langate has over two decades of experience building HIPAA-regulated healthcare software—EMR/EHR systems, patient portals, medical billing and feedback SaaS platforms, provider workflows, hospital management, and medical device software. They also design enterprise-grade BI and analytics systems for healthcare and pharma Clients.

Certifications and compliance

HIPAA, GDPR compliance. Microsoft Gold Partner ensuring secure, certified .NET and Azure solutions.

Experience with clinicians

No explicit in-house clinical teams noted. Typically operates with Client-supplied domain specifications for healthcare features in partnership projects.

Healthcare tech stack

.NET (C#), ASP.NET Core, Angular, SQL Server, Azure, HL7, FHIR.

Standards for data exchange

FHIR and HL7 (EHR integrations, including Allscripts portals) implied through EMR/EHR projects and case study examples.

Recent case study

- Patient feedback SaaS development – built a web app with EMR integrations and analytics for patient satisfaction reporting, improving feature delivery quality for a U.S. SaaS provider.

- Healthcare eligibility and billing platform expansion – extended a long-term care SaaS from startup to a system powering hundreds of healthcare organizations using .NET Core, Angular, and Azure; scaled transaction volume dramatically while achieving Epic Connect readiness.

Security maturity

Delivers HIPAA and GDPR-compliant DevSecOps practices: encrypted data in transit and at rest, secure pipelines, access control policies, regular audits, and Microsoft-certified architecture via Azure and DevOps approaches.

#10 Kanda Software

Founded: 1992

Headquarters: Newton, Massachusetts, USA

Delivery centers: U.S.-based leadership with engineering teams from Europe and Latin America (two-shore model)

Team size: ~200–500

Hourly rate: $60–$120

Best for: HIPAA-compliant cloud-based healthcare and life sciences systems, precision medicine platforms, ADR detection tools.

Core healthcare specialties

Kanda specializes in digital healthcare and life sciences software—cloud-native precision medicine platforms, telemedicine and mHealth apps, EHR and EMR systems, clinical decision support, medical device integrations, hospital and biotech tools, diagnostics, clinical genomics analytics, and prescription ADR detection platforms.

Certifications and compliance

HIPAA, HITRUST, FDA, CLIA, NIST, SOC 2, ISO 27001, ISO 9001. AWS Healthcare Competency recognized vendor.

Experience with clinicians

Engages clinicians, scientists, and clinical advisory boards. Client case studies show collaboration with oncologists and medical experts in developing precision medicine tools and ADR platforms.

Healthcare tech stack

AWS, .NET (C#), Python, Java, React, PostgreSQL, FHIR.

Standards for data exchange

FHIR, HL7 v2 and v3, DICOM, SNOMED, LOINC, ICD-10.

Recent case study

- Trapelo precision oncology platform – migrated to AWS cloud to build HIPAA-compliant precision medicine platform with encrypted data management, real-time decision support for oncologists, and robust testing pipeline.

- ADRS detection platform – improved clinician UX and search accuracy on adverse drug reaction tool by streamlining UI/UX, enhancing relevant search features, and improving workflow depth for healthcare professionals.

- Global telehealth and mHealth platform – took over engineering and infrastructure for a major provider; improved platform UX, stability, and compliance via AWS, DevOps, and agile practices.

Security maturity

Implements HIPAA-compliant DevSecOps with encryption in transit and at rest, RBAC controls, continuous auditing, SIEM monitoring, AWS Healthcare Competency-level architecture and governance, and full documentation support for audits.

Afterthought

Our evaluation criteria were designed to cut through the noise and highlight firms that deliver real business value. From HIPAA checklists to FHIR integration, from clinician-informed design to security maturity – we looked for signals that actually matter in practice.In short: it’s not about who promises the most – it’s about who delivers where it counts. If you need any help with healthcare software development, contact us at SumatoSoft.

Let’s start

If you have any questions, email us info@sumatosoft.com