Overview: IoT in Banking – Existing and Future Use Cases

In an era where digital transformation dictates competitive advantage, how can banks leverage IoT to stay ahead?

The answer lies not only in adopting new technologies but in reimagining the role they play in day-to-day businesses. From IoT-enabled ATMs that self-diagnose malfunctions to banking cards that alert users to fraud in real time, banks are already harnessing IoT to transform the customer experience and reinforce security measures.

At SumatoSoft, we saw multiple implementations of the Internet of Things when providing banking IoT development services. Here, I want to share all this accumulated knowledge from the past 12 years of cooperating with banks.

In this article, I’ll describe:

- benefits – the reason why banks strive to adopt the IoT;

- how to implement IoT in banking;

- challenges – issues and obstacles banks face implementing the technology;

- existing and future implementations of IoT in banking – it’s about how the implemented systems look like.

What the Internet of Things Is About

The Internet of Things (IoT) encompasses a vast network of interconnected devices, each embedded with sensors, software, and other technologies, aiming to exchange and collate data with other devices and systems over the Internet. This expansive web of devices, ranging from the mundane to the highly sophisticated, allows for seamless communication without human intervention, facilitating real-time data collection and analysis.

In the context of banking, IoT’s potential extends far beyond mere operational efficiencies. The banking industry is keenly exploring IoT’s potential to redefine the very essence of banking in the digital age. But what do they get from implementing IoT?

Advantages: What Banks Get From Implementing IoT

The integration of the Internet of Things in the banking sector has multifaceted impacts across various dimensions of banking. Let’s examine 6 advantages of the IoT in banking:

Customer Insights and Personalization

Big data analytics. IoT facilitates deep insights into customer behaviors, such as ATM usage patterns, branch visits, and digital interactions. This data enables banks to tailor personalized offers and promotions, enhancing customer satisfaction.

Enhanced customer experience. Smart branches and ATMs, equipped with IoT technologies like biometric authentication and NFC communication, significantly reduce waiting times and elevate service convenience.

Operational Efficiency and Cost Savings

Automation of routine tasks. JPMorgan Chase’s COiN platform exemplifies how AI and IoT can automate complex processes like commercial loan agreement reviews, previously consuming 360,000 hours annually, now executed in seconds.

Smart infrastructure management. IoT-driven management of bank infrastructure that ranges from lighting to heating not only ensures energy efficiency but also reduces operational costs.

Improved Asset Management

Real-time asset monitoring. Deploying IoT sensors in data centers and ATMs allows for the real-time monitoring of assets, predicting failures and reducing downtime.

Optimized cash management. IoT enables predictive replenishment of ATMs, ensuring optimal cash availability while minimizing logistics costs.

Enhanced Security and Fraud Prevention

Real-time fraud detection. IoT sensors and machine learning algorithms offer a layer of security that can detect physical tampering and suspicious behaviors in real time, making fraud detection more comprehensive.

Advanced biometric authentication. Utilizing sophisticated biometric methods enhances customer identification and security, reducing the risk of fraud.

Skimming and physical security. Connected surveillance systems and environmental cameras around ATMs combat skimming and other physical threats by monitoring for unusual activity and device tampering.

Sustainable Practices and Environmental Impact

Green banking initiatives. IoT-controlled energy management systems contribute to sustainability by optimizing resource use in bank operations, significantly lowering the environmental footprint.

Digital transition and paper waste reduction. Promoting digital processes through IoT devices reduces the reliance on paper, streamlines operations, and contributes to environmental conservation.

Risk Management and Compliance

Continuous monitoring for risk assessment. IoT enables banks to continuously monitor transactions and customer behaviors for improved risk management and compliance with regulatory standards.

Regulatory technology (RegTech) advancements. Automation facilitated by IoT aids in compliance management, enhancing the efficiency of anti-money laundering (AML) efforts and ensuring adherence to regulatory requirements with less manual effort.

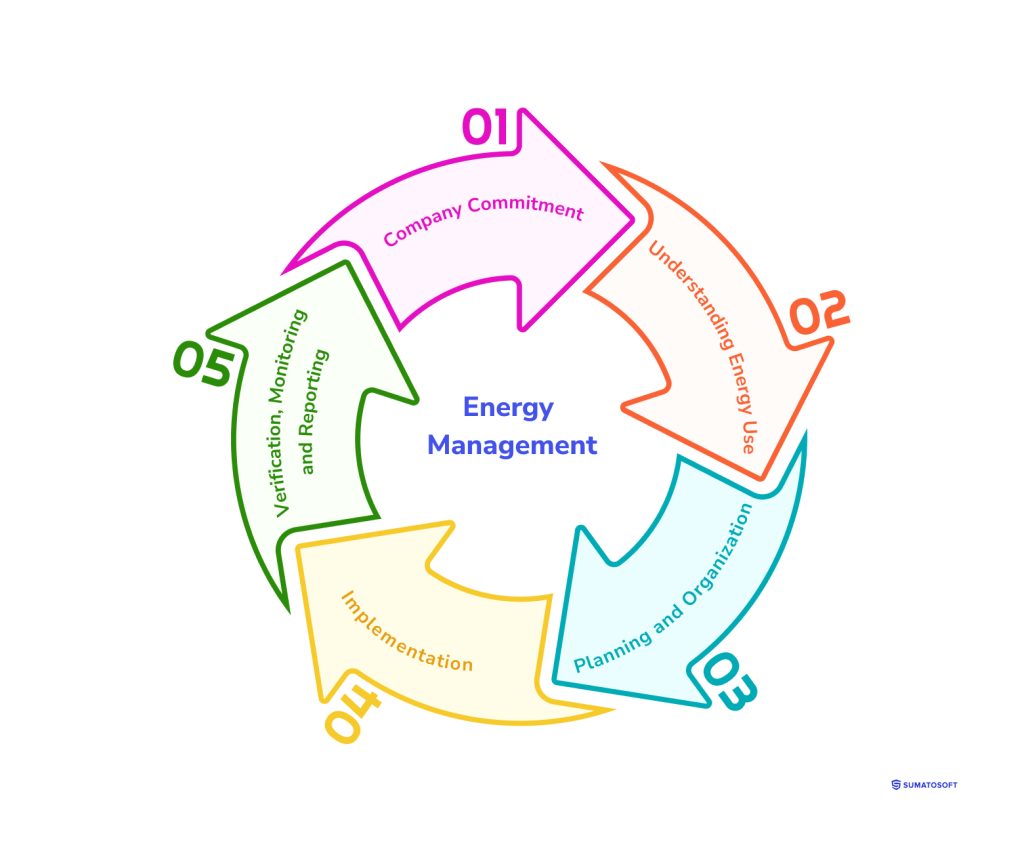

How to Implement IoT in Banking

The approach to developing IoT solutions for the banking sector must be meticulous and structured, ensuring that each step contributes to a seamless integration and maximization of IoT’s potential benefits. Here’s a snapshot of our development roadmap and approach to the IoT design:

Bank’s Needs Assessment and Strategy Development

This initial phase involves a thorough analysis of the bank’s specific needs and objectives for incorporating IoT technologies. Identifying the key challenges and opportunities within the bank’s operations helps in crafting a tailored strategy. This step is crucial for setting clear goals and expectations for the IoT integration, ensuring it serves the bank’s long-term digital transformation aspirations.

Solution Design and Prototyping

With a strategic foundation in place, the next step focuses on designing the IoT solution. Selecting the right mix of sensors, devices, and connectivity options is critical to building an effective IoT architecture. Prototyping is an integral part of this phase, providing a tangible model for stakeholders to review, enabling early feedback and adjustments before proceeding to full-scale development.

Integration and Deployment

The integration phase sees the IoT devices and systems being carefully integrated with the bank’s existing infrastructure. The process is managed to minimize disruption to ongoing operations, with deployment typically executed in a phased manner. Rigorous testing is conducted throughout to ensure the system’s reliability and security before it goes live.

Data Analytics and Insights Generation

A key benefit of IoT in banking is the ability to generate valuable insights from data collected across various touchpoints. Implementing advanced analytics and machine learning algorithms is essential at this stage to process and analyze the data.

Security and Compliance

Given the sensitivity of banking operations, ensuring the security of the IoT ecosystem is paramount. This involves implementing encryption for data transmission, securing endpoints, and adhering to regulatory compliance standards. Security measures are integrated throughout the development process to protect against data breaches and ensure customer privacy.

Maintenance and Continuous Improvement

After deployment, the focus shifts to maintaining the IoT system’s performance and adaptability. Regular monitoring, troubleshooting, and well-established IoT updates management are necessary to keep the system running efficiently. Additionally, a continuous improvement process is established to refine and enhance the solution over time, based on performance data and user feedback.

This structured approach ensures that the development and integration of IoT solutions in banking are conducted with a clear focus on meeting specific operational needs, enhancing customer experience, and achieving strategic business objectives.

Yet, despite the benefits IoT brings to banks, its implementation poses formidable challenges. Navigating the complexities of implementation is the next exciting topic for discussion.

Challenges of Implementing IoT in Banking

According to the research from Academia Edu, an open repository of academic articles in San Francisco, US, the major challenges of implementing IoT in banking include security concerns, regulatory issues, and the need for substantial investment in technology and training (the research is only available for registered users, it’s called Mediating and Moderating Factors Affecting Readiness to IoT in the Banking Industry: A Conceptual Framework).

Security and Privacy Concerns

The integration of IoT devices into banking infrastructure introduces complex security challenges. These devices often become new targets for cybercriminals seeking to exploit vulnerabilities for data breaches or unauthorized access.

For example, in 2017, the Mirai botnet attack highlighted the vulnerabilities in IoT devices, which could also impact the banking sector if similar devices are compromised. Banks must ensure robust security protocols are in place to protect sensitive customer information and maintain trust. It would only be possible if the developers refer to the best Internet of Things design practices.

Data Management and Analysis

IoT devices generate an immense volume of data, presenting challenges in processing, storing, and analyzing this information effectively.

The case of JPMorgan Chase’s COiN platform illustrates how banks can leverage AI to manage data from contracts efficiently. However, extending this capability to the broader IoT landscape requires advanced analytics tools and skills, making it a significant hurdle for many institutions.

Integration with Existing Systems

Many banks operate on legacy systems that are not initially designed to interface with IoT technologies. Integrating IoT solutions can be a complex and costly process, involving substantial changes to existing IT infrastructure. A notable example is the challenge older banks face when trying to incorporate mobile banking solutions, which can be seen as a precursor to more complex IoT integrations.

Regulatory Compliance

The banking sector is heavily regulated, with stringent requirements for data protection, privacy, and security. IoT implementations must comply with regulations such as GDPR in Europe, which imposes strict data handling and privacy rules. Compliance becomes more challenging as IoT devices increase the points of data collection and processing, requiring banks to ensure that all IoT applications meet these legal standards.

Cost Implications

The initial investment and ongoing maintenance costs of IoT technology can be significant. This includes the costs of hardware, software, integration, and ensuring continuous security and compliance. For smaller banks, the cost of deploying an IoT infrastructure may be prohibitive, limiting their ability to adopt IoT solutions.

A practical example can be drawn from the banking industry’s investment in ATM upgrades to support EMV (Europay, MasterCard, and Visa) technology, which was a costly endeavor for many institutions, hinting at the financial challenges IoT implementation could pose.

The transition was costly, with banks like Fifth Third Bancorp estimating around $15 million for EMV upgrades in just the latter half of a year. Each EMV chip card’s production cost ranged between $3.50 and $4, and ATM upgrades to accept these cards were estimated to cost between $2,000 and $3,000 per machine.

These challenges underscore the need for a strategic approach to the adoption of IoT in banking, with a clear focus on mitigating risks, managing costs, and ensuring seamless integration into the existing banking ecosystem.

With the theoretical groundwork laid out, we now turn our attention to the existing reality of IoT in banking. The following sections detail ten exemplary real-life implementations, highlighting how banks worldwide are effectively utilizing IoT technology.

IoT In Banking: 10 Most Common Existing Implementations

#1 Automated Teller Machine (ATM)

The Automated Teller Machine (ATM), introduced in the 1960s, was a significant milestone in banking automation, pre-dating the formal concept of the Internet of Things (IoT). ATMs don’t technically refer to the IoT since it doesn’t collect and analyze massive amounts of data, still, they laid the groundwork for the interconnected, automated systems that characterize today’s applications of IoT in banking and beyond.

ATMs enable electronic communication for transactions without human intervention, which is a foundational principle of IoT – connecting devices to perform tasks and process data autonomously.

Modern ATMs extend far beyond cash withdrawals and balance checks. They now offer bill payments, mobile phone top-ups, fund transfers, depositing checks and cash without envelopes, printing or emailing detailed transaction receipts, changing PIN numbers, accessing financial products like loans and insurance, and much more.

#2 Smart Terminals

Smart terminals are multifunctional devices that facilitate electronic payment transactions while connecting to the internet to offer additional services such as inventory management, customer relationship management, and data analytics.

These terminals go beyond merely processing payments, integrating advanced features that support a wide range of payment methods, including contactless, NFC (Near Field Communication), chip and PIN, and mobile wallet technologies. They are designed to enhance the customer experience, streamline business operations, and provide merchants with valuable insights into sales and customer behavior.

A practical example is the Poynt Smart Terminal, which features dual screens for both merchant and customer interactions, a built-in printer, and the ability to run third-party applications for tailored business operations, such as appointment scheduling or order management.

Key benefits include:

- faster transaction processing;

- personalized customer interactions;

- enhanced security through encryption and tokenization;

- mobility, allowing businesses to conduct transactions anywhere.

#3 Wearable Device Payments

Wearable device payments refer to the method of conducting financial transactions through devices that can be worn, such as smartwatches, fitness bands, and smart rings. These devices come equipped with NFC (Near Field Communication) technology, which facilitates secure, contactless payments by allowing the user to wave or tap their wearable device over a payment terminal that supports this technology.

This form of payment prioritizes convenience and efficiency, eliminating the need to carry physical credit cards or to pull out a smartphone to complete a transaction. It exemplifies the innovative use of IoT in the financial sector by integrating payment technology into everyday wearable items, thereby streamlining the consumer experience for a variety of transactions.

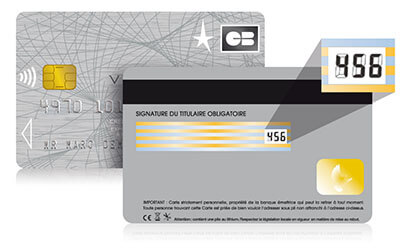

#4 Smart Cards with Dynamic CVV2

Smart cards with dynamic CVV2 are a security feature for debit and credit cards that enhances protection against fraud. Unlike traditional cards with a static Card Verification Value (CVV2) printed on the back, smart cards with Dynamic CVV2 change their CVV2 number at regular intervals, such as every hour or every transaction.

This dynamic CVV2 makes it much harder for fraudsters to use stolen card information for unauthorized online or phone transactions since the CVV2 changes frequently, rendering the stolen data quickly obsolete.

There are two approaches:

- The first approach involves the usage of small displays on the back of the credit card with CVV2 code that automatically changes at a regular interval. An example of this technology is the Motion Code™ credit card developed by IDEMIA. The card features an e-paper display on the back, where the traditional static 3-digit CVV2 is replaced with a digital screen that displays a new CVV code at set intervals.

- Another approach is digital, where a customer gets a new CVV2 through his banking app. An example is the Dynamic Code Verification card offered by Visa. Instead of relying on a physical display, Visa’s system allows issuers to generate up to 24 dynamic CVV2 codes per request. These codes can be sent directly to the cardholder’s mobile device or accessed via the issuer’s online banking application.

#5 Smart Transaction Verification (STV)

Smart Transaction Verification (STV) refers to the process of using technology to verify banking and payment transactions. This method includes:

- Biometric verification through fingerprint scanning, facial recognition, and voice recognition.

- One-time passwords (OTPs) which are unique, generated, time-sensitive codes sent to the user’s registered device or email, which must be entered to complete the transaction.

- Two-factor authentication (2FA) which requires two different forms of identification from the user; for example, something the user knows (a password) and something the user has (a mobile phone with an installed verification application).

- Multi-factor authentication (MFA) which is an extension of 2FA that requires two or more verification factors, adding layers such as a biometric check or a smart card, significantly enhancing security.

- Geolocation verification which uses the user’s location at the time of the transaction and compares it against known patterns or restricted locations to flag potential fraud.

- Device fingerprinting that allows to perform transactions only through specific pre-registered devices.

#6 Automated Queuing Systems

AQS are technologically driven solutions designed to manage and streamline the process of handling waiting lines in various service-oriented sectors. These systems replace traditional, linear queuing methods with digital or virtual queue management, allowing customers to wait for their turn without physically standing in line.

AQS employs software and hardware components, such as digital displays, ticketing machines, and mobile applications, to organize customer flow and enhance the efficiency of service delivery.

These systems integrate ticketing kiosks for virtual queue joining, digital signage for real-time status updates, and mobile apps for remote queuing and notifications. They support appointment scheduling, enable customer feedback collection, and offer analytics for service improvement.

Major banks like JP Morgan Chase, HSBC, DBS Bank, Santander UK, and more have adopted AQS.

#7 Wi-Fi and Connectivity Solutions in Branches

Wi-Fi and connectivity solutions in branch offices refer to the deployment of wireless internet access and network connections within bank branches. This technology has become widespread in banking branches as part of a broader digital transformation strategy.

These solutions enable both customers and staff to access banking services, applications, and the internet via mobile devices, laptops, and other wireless-enabled devices within the premises. Banks globally are integrating advanced connectivity to not only provide value-added services to customers in-branch but also to leverage data analytics for personalized service offerings and operational insights.

#8 Energy Management

Energy management in banking, facilitated by IoT, involves using sensors and smart devices to monitor and control the energy consumption of bank branches and ATMs. This can include adjusting lighting, heating, and cooling based on occupancy or time of day to reduce energy waste.

IoT devices can autonomously adjust the thermostat settings in a branch or turn off lights in unoccupied areas. Advanced systems can even predict energy needs based on historical data and weather forecasts.

Nowadays, banks’ implementations of ESG (Environmental, Social, and Governance) considerations are a compelling example of how financial institutions try to integrate sustainability into their operation.

#9 Digital Signage and Information Kiosks

Digital Signage and Information Kiosks in the banking sector are innovative technologies aimed at enhancing the customer experience within bank branches.

Digital signage involves the use of electronic displays to provide customers with real-time information (like exchange rates), advertisements, and personalized messages. These displays can be found throughout bank branches, offering updates on financial products, services, and other relevant information to help customers make informed decisions.

Information kiosks, meanwhile, are interactive terminals where customers can conduct various banking transactions or access detailed information about their accounts and bank services without the need for direct interaction with bank staff. These kiosks support a range of functions, from account inquiries and money transfers to loan applications, thereby streamlining operations and reducing wait times.

A great example is the self-service digital kiosks by HOLDERS and DBS Bank in Singapore.

#10 Advanced Security Systems

Advanced Security Systems in banking encompass technologies aimed at safeguarding both physical and digital banking realms. Key examples include:

- Biometric security systems. These systems use fingerprints, facial recognition, and iris scans for secure authentication, enhancing security beyond traditional methods.

- AI-equipped surveillance. AI-driven surveillance detects suspicious behaviors and potential security breaches, alerting security personnel to unusual activities.

- Cybersecurity solutions. Include firewalls, intrusion detection, and prevention systems to protect against hackers, malware, and phishing attacks.

- Encryption technologies. Banks employ advanced encryption to protect sensitive customer data during transmission, thwarting data breaches and identity theft.

- Fraud detection systems. Utilize machine learning and analytics to spot and prevent fraudulent transactions by monitoring for anomalies.

- Physical access control. Systems restrict entry to sensitive bank areas, incorporating card readers, keypads, and biometric scanners for authorized access only.

Banks like JPMorgan Chase & Co., HSBC, and Citibank have implemented these systems, showcasing the industry’s push toward using technology for enhanced security.

That’s it regarding the existing applications. Let’s move on to some perspective implementations that big financial organizations in the world are actively developing.

Future of IoT in Banking: 5 Upcoming Trends

The upcoming section delves into future trends in banking technology, spotlighting innovations that, while already in existence, have yet to achieve widespread adoption compared to the applications discussed in the previous section.

As the industry continues to evolve, these trends offer a glimpse into the future of banking, where advanced solutions could become standard practices.

#1 Biometric Authentication for Cards

Biometric Authentication for Cards integrates fingerprint sensors or similar technology into credit and debit cards, allowing for secure and convenient transactions. This method ensures that only the registered cardholder can use the card, as it requires biometric verification at the point of sale, eliminating the need for PINs or signatures.

While it offers enhanced security and a smoother checkout process, challenges such as production costs, the necessity for updated payment systems, and privacy concerns hinder widespread adoption. Financial institutions are exploring this technology to improve security and customer experience, with trials by major companies like Mastercard and Visa highlighting its transformative potential.

#2 Video Teller Machines (VTMs)

Video teller machines merge the convenience of ATMs with the personal touch of face-to-face interaction. VTMs are equipped with video conferencing technology, allowing customers to conduct transactions and receive banking services in real-time with the assistance of a remote teller.

This hybrid approach extends the range of services available through a machine, including complex transactions traditionally reserved for in-branch visits. Examples are account inquiries, money transfers, check cashing, and loan applications, with the added benefit of direct communication with bank staff, making it a versatile tool in modern banking.

This technology enables banks to offer extended service hours and reduce wait times, improving overall customer satisfaction while optimizing staff resources and branch operations.

Bank of America, ProFed Credit Union, Citibank, and other companies gradually deploy VTMs, while other banks across the world are adopting this technology.

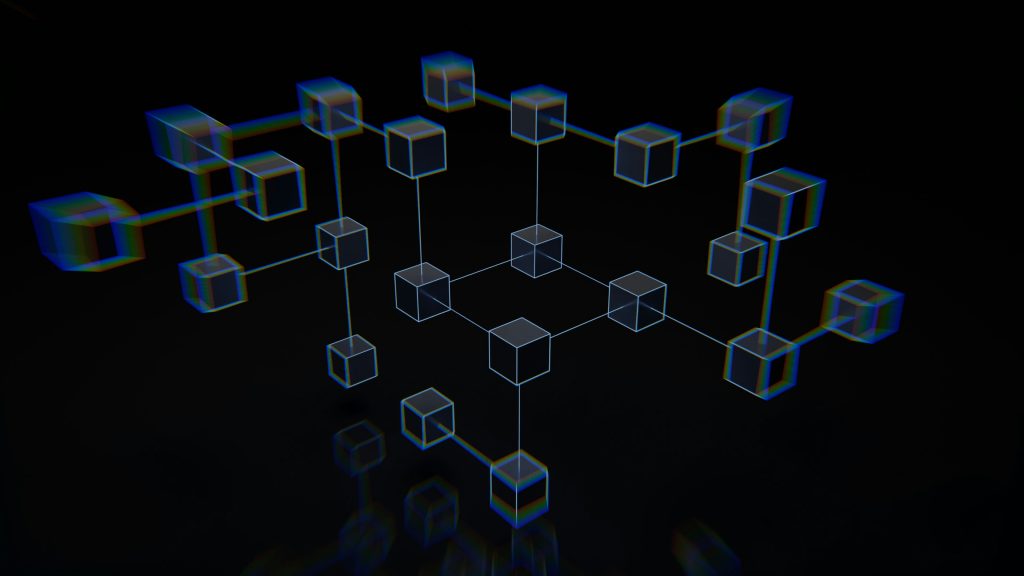

#3 Blockchain and IoT for Secure Transactions

Blockchain and IoT integration offers enhanced security for financial transactions by leveraging blockchain’s decentralized, immutable ledger with IoT’s real-time data collection. This combination ensures data integrity, reduces fraud risk through decentralization, and enables automatic transaction execution via smart contracts, all while protecting privacy with advanced encryption. This approach is increasingly considered in sectors beyond finance, including supply chain and healthcare, for secure, efficient transactions.

Several banks and financial institutions have experimented with Blockchain and IoT technologies to enhance their services and security measures. For instance:

- JPMorgan launched its blockchain-based interbank information network, IIN, which allows member banks to exchange information in real-time to verify that a payment has been approved.

- HSBC has utilized blockchain technology for trade finance transactions to reduce the time and cost of processing paperwork.

- Bank of America has filed numerous patents related to blockchain technology, indicating its experimentation and interest in integrating blockchain into its operations.

#4 Smart Voice Assistance

Smart Voice Assistance in banking refers to the integration of voice recognition technology and artificial intelligence (AI) to facilitate banking operations through voice commands. This technology allows users to interact with their bank’s services using natural language, enabling tasks such as checking account balances, transferring funds, paying bills, and receiving financial advice without manual input on a device.

The implementation of Smart Voice Assistance in banking is accomplished through virtual assistants and voicebots integrated within mobile banking apps, online banking platforms, or smart home devices. These systems leverage natural language processing (NLP) and machine learning to understand and process user requests, conduct transactions, and provide personalized financial insights.

A notable example of Smart Voice Assistance in banking is Erica, Bank of America’s virtual assistant. Erica helps customers with tasks like checking balances, scheduling payments, and providing credit report updates, all through voice commands.

#5 Smart Branches

Smart Branches encapsulate the culmination of various Internet of Things (IoT) applications discussed earlier, integrating all technologies we discussed within a single, physical bank branch.

This holistic approach combines efficiency, security, and personalized customer experiences, showcasing how banks are leveraging IoT to revolutionize both current operations and future banking practices.

It’s still more a concept than a reality.

How SumatoSoft Integrates IoT in Banking

We at SumatoSoft have been developing IoT software development services and IoT banking development services since 2012, delivering custom enterprise software and MVPs to startups. We specialize in IoT development and have won numerous rewards in this category:

- top IoT company by Clutch in 2023;

- top IoT company by Techimply in 2023;

- runner-up in the category IoT contributor of the year 2023 by Hackernoon.

Facts about SumatoSoft:

- We strive for quality and security, and ISO 27001 and ISO 9001 certificates can prove it.

- We focus on long-term cooperation. 70% of our Clients come back to us with another project.

- Our Client’s satisfaction rate is 98%, thanks to our firm commitment to deadlines and their needs.

- Your project data stays safe. We guarantee the security of all data related to your project.

- We only release the software if it meets the specified percentage of acceptance criteria. The percentage is agreed upon with you in the quality assurance strategy.

- 70% of our team is senior-level developers and QA engineers who ensure the app complies with domain best practices and our inner quality assurance guidelines.

We tried another company that one of our partners had used but they didn’t work out. I feel that SumatoSoft does a better investigation of what we’re asking for. They tell us how they plan to do a task and ask if that works for us. We chose them because their method worked with us.

The SumatoSoft team has built 250 custom software solutions for 27 countries for 11 industries. After more than 12 years on the market, the company became a reliable technical partner to its Clients, demonstrating a 98% Client satisfaction rate with the quality of services they provide.

Contact us to get a free quote for your project.

Conclusion

The integration of IoT in banking is not just a glimpse into the future; it’s a vivid portrayal of a present where efficiency, security, and personalized customer service converge. From the foundational elements of ATMs and smart terminals to the innovative horizons of biometric cards and blockchain transactions, IoT is reshaping the way banks operate and interact with their customers. And SumatoSoft helps to do so. Get in touch in case you have an IoT project!

Let’s start

If you have any questions, email us info@sumatosoft.com