How to Build Construction Equipment Cost Management Software

Construction companies lose significant money not only because of fuel prices or maintenance costs, but also due to poor visibility into equipment utilization, downtime, and true ownership expenses. Idle machinery, inaccurate charge rates, and fragmented data across spreadsheets and departments lead to cost leakage, flawed project estimates, and lower margins. External risks amplify the situation: in the U.S. alone, annual construction equipment theft is estimated at $300–$1,000 million (National Equipment Register), while most industry assessments converge around ~$400 million per year.

This article explains how construction companies can improve equipment cost control and utilization by treating equipment management as an economic system supported by software.

We cover key equipment management strategies, explain how total cost of ownership (TCO) and charge rates are calculated, and show how these calculations translate into a centralized system architecture. The article also includes a real-world example based on SumatoSoft’s experience building an equipment management platform, illustrating how such systems work in practice.

How we developed a construction equipment cost management software

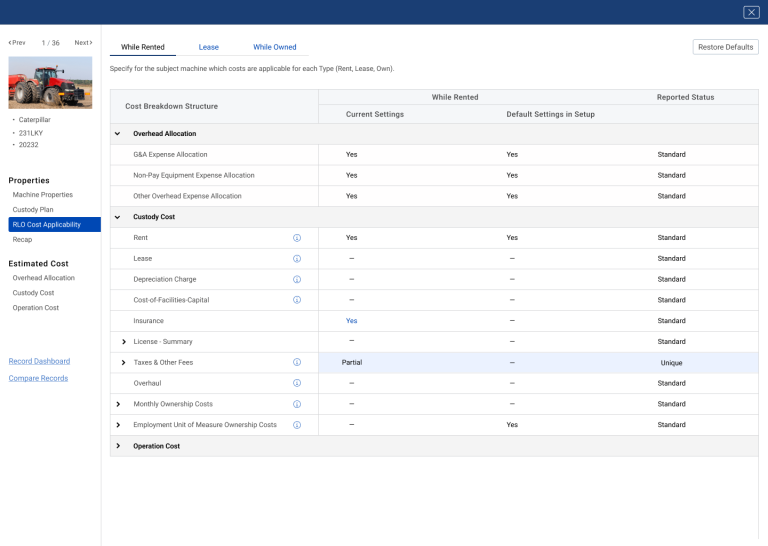

Our Client was an infrastructure construction company preparing and pricing bids for capital-intensive projects. The primary software users were teams responsible for equipment economics and bid preparation, operating fleets with many equipment types and long lifecycle horizons.

The core goal was to make accurate charge rate calculations. To do that, we had to model construction equipment cost economics at a deep, systematic level, understanding how ownership, operation, utilization, and lifecycle parameters interact and turning that understanding into a reliable basis for charge rate decisions.

To achieve this, we went far beyond implementing formulas. We decomposed construction equipment economics into explicit, configurable cost structures and rebuilt them as a coherent calculation model that could adapt to different equipment types, usage patterns, and bidding assumptions without breaking internal consistency.

This resulted in a system that models:

- Custody and operating cost components are first-class entities.

- Utilization-driven charge rate logic tied to real employment schedules.

- Equipment-specific parameters layered on top of shared economic rules.

- Scenario-based recalculation of charge rates as assumptions change.

- Traceable calculation paths that make every charge rate explainable.

This level of modeling depth allowed the platform to reflect how construction equipment actually behaves economically across its lifecycle.

The full case description is available on our case study page.

Now, let us speak from our experience and what we’ve learned.

Benefits of cost-aware equipment management

Proper construction equipment cost management offers numerous benefits for both construction companies and equipment lenders, ultimately leading to reduced costs, increased profits, and more efficient operations through better control of equipment economics and charge rate logic.

Reduced costs and increased profits

Effective management of construction equipment can help construction managers optimize expenses related to equipment operation, maintenance, usage, and storage when these costs are explicitly tracked and reflected in charge rate calculations. This ensures that the cost of the equipment is justified in the long run and that it generates a high ROI based on actual utilization and lifecycle assumptions. Equipment lenders, too, can increase their profits by offering competitively priced rental or leasing rates based on accurate cost assessments rather than aggregated averages.

Effective construction equipment management helps organizations control expenses related to equipment ownership, operation, maintenance, and storage across the full lifecycle when these expenses are modeled as part of a unified cost structure. This ensures that equipment costs are justified over time and aligned with actual usage patterns. For equipment lenders, accurate cost modeling enables competitively priced rental or leasing rates that protect margins while remaining attractive to the market.

Optimized equipment utilization

Both construction companies and equipment lenders benefit from optimizing the use of their equipment when utilization is measured and reflected in economic models. Proper management ensures that equipment is available when needed, minimizes idle time that distorts charge rate assumptions, and maximizes the equipment’s lifespan, contributing to better overall utilization from a cost perspective.

Improved project planning and scheduling

Construction companies that are effectively managing construction equipment from a cost and utilization standpoint can plan and schedule their projects more accurately. This includes allocating equipment and resources based on realistic cost assumptions, ensuring that project timelines are met, and avoiding costly delays or downtime caused by mispriced or unavailable equipment.

Better decision-making under uncertainty

Accurate equipment management improves decision quality when assumptions change. Whether adjusting utilization, revising bid inputs, or evaluating alternative scenarios, teams can understand cost implications faster and with greater confidence.

5 strategies for effective construction equipment cost management

Effective construction equipment management is not limited to physical control of assets. In practice, it is a set of economic strategies that directly influence charge rate accuracy, bid reliability, and lifecycle profitability.

Strategy #1: Control custody and handling costs through disciplined storage and transportation

Storage and transportation conditions directly affect custody costs, depreciation, and equipment availability. Poor handling increases hidden cost components that later distort charge rate calculations. Managing these conditions consistently helps stabilize cost assumptions and reduces unexpected cost leakage over the equipment lifecycle.

Strategy #2: Use preventive monitoring to stabilize lifecycle costs

Regular inspections and continuous monitoring allow teams to identify wear patterns early and plan maintenance before failures occur. We enable such an opportunity with our predictive maintenance development services. From a cost perspective, this reduces volatility in operating expenses and improves the predictability of lifecycle cost models. Backup and contingency planning further protect bid assumptions from disruption caused by unexpected downtime.

Strategy #3: Treat theft and loss as cost and risk factors

Equipment theft is not only a security issue but a direct financial risk. Losses affect asset value, utilization assumptions, and replacement costs. Applying tracking, access control, and monitoring measures helps protect equipment value and preserves the integrity of cost calculations used in bidding and planning.

Strategy #4: Plan equipment lifecycle decisions economically

Effective lifecycle management requires understanding when maintenance costs begin to outweigh asset value. Factoring acquisition, operation, maintenance, and disposal into a unified lifecycle view enables better replacement timing and more accurate long-term charge rate planning.

Strategy #5: Improve utilization through training and operational discipline

Well-trained operators reduce equipment misuse, downtime, and accidental damage. From an economic standpoint, this leads to more stable utilization rates and more reliable cost assumptions, which are critical inputs for accurate charge rate and bid calculations.

The role of technology in construction equipment cost management

Technology plays a supporting role in construction equipment management. Its purpose is not to replace operational expertise, but to make equipment economics measurable, explainable, and usable for decision-making.

At a system level, technology should support four core capabilities:

- Data collection and normalization – capture equipment data from multiple sources and structure it consistently so costs, utilization, and lifecycle parameters can be analyzed together.

- Cost tracking and calculation – translate raw operational data into custody costs, operating costs, and charge rates that reflect how equipment is actually used over time.

- Analytics and scenario modeling – enable fast recalculation when assumptions change, allowing teams to explore alternative scenarios and understand cost implications before making bid decisions.

- Integration with enterprise processes – fit into existing financial, operational, and planning workflows instead of becoming an isolated tool.

Off-the-shelf software can address parts of this problem. However, when accurate charge rate logic, flexible equipment modeling, and performance at scale are critical, organizations often require a system designed around their specific economic and operational realities.

This is the approach we applied in our construction equipment management case, where the system was built around cost logic and decision needs rather than a predefined product structure.

How to build a construction equipment cost management software

Step #1: Modeling TCO as a software calculation layer

Total Cost of Ownership (TCO) is the foundation of any reliable construction equipment cost management system. However, in practice, TCO cannot exist as a single aggregated number or a static spreadsheet formula. To support accurate charge rate calculations, scenario modeling, and large-scale recalculations, TCO must be modeled in software as a structured calculation layer composed of independent but connected cost components.

In the system we built, TCO represents the full economic lifecycle of each piece of equipment. Instead of hardcoding assumptions, we decomposed equipment economics into explicit cost entities that can be updated, recalculated, and audited as conditions change. This approach allows charge rates to remain consistent even when utilization patterns, financing terms, or operating costs are revised.

The TCO model includes the following cost components:

- Acquisition cost – purchase price or lease cost, financing terms, and acquisition date.

- Operating costs – fuel, oil and lubricants, tires and tracks, permanent attachments such as machine control systems, tracking devices, and communication equipment.

- Maintenance and repair costs – preventive and corrective maintenance, replacement parts, supplies, fluids, labor, and service providers.

- Labor costs – wages and benefits of equipment operators and maintenance personnel.

- Fees and charges – insurance, taxes, licenses, and regulatory fees associated with ownership or usage.

- Depreciation and interest – asset value reduction over time and the cost of capital used to finance the equipment.

- Storage and transportation costs – expenses related to storing equipment and moving it between job sites.

- Disposal costs – resale, trade-in, or scrapping costs at the end of the equipment’s economic life.

How this logic is implemented in software

From a software perspective, each cost component is stored and managed independently rather than embedded inside a single formula. Equipment units are linked to their own TCO profiles, while global parameters such as interest rates or depreciation rules are managed centrally. When any cost input changes, the system automatically recalculates TCO and propagates the update to all dependent charge rate calculations.

This approach ensures that:

- Equipment costs remain transparent and explainable.

- Historical calculations stay traceable even after assumptions change.

Charge rates are always based on the current economic reality rather than outdated averages.

Step #2: Implementing equipment charge rate calculation in software

Once the Total Cost of Ownership (TCO) is modeled as a structured calculation layer, the next step is translating those costs into accurate equipment charge rates used for construction bidding and internal planning. In software, charge rates are not static values; they are derived results that depend on utilization assumptions, indirect cost allocation, and target profitability.

In the system we developed, charge rate calculation was implemented as a reusable calculation service built on top of the TCO model. This service continuously converts equipment economics into consistent hourly charge rates for use across bids, project planning, and internal analysis.

At a conceptual level, the charge rate consists of three primary inputs:

- Direct equipment costs, derived from TCO.

- Indirect costs, such as general and administrative (G&A) expenses.

- Profit margin, reflecting the company’s target return.

Charge rate calculation logic

The core calculation logic follows a transparent and explainable structure:

- Calculate the cost portion of the charge rate.

This includes direct equipment costs and allocated indirect costs, normalized by expected utilization:

Cost Portion = (TCO / Total Usage Hours) + (G&A Expenses / Total Usage Hours)

- Apply the profit margin.

The profit margin is calculated as a percentage of the cost portion:

Profit Margin Portion = Cost Portion × Profit Margin Percentage

- Derive the final charge rate.

Charge Rate = Cost Portion + Profit Margin Portion

Example of charge rate calculation:

To illustrate how this works in practice, consider the following scenario:

- Annual TCO for a piece of equipment: $120,000

- Expected annual utilization: 2,000 hours

- Annual G&A expenses allocated to the equipment: $50,000

- Target profit margin: 20%

First, calculate the cost portion:

- ($120,000 / 2,000) + ($50,000 / 2,000)

- $60 + $25 = $85 per hour

Next, calculate the profit margin portion:

- $85 × 0.20 = $17 per hour

Final charge rate:

- $85 + $17 = $102 per hour

In this example, the charge rate with a 20% profit margin is $102 per hour.

How this logic is implemented in software

In software, all inputs to the charge rate calculation (TCO components, utilization assumptions, G&A allocation rules, and profit margins) are stored as configurable parameters rather than hardcoded values. When any assumption changes, the system automatically recalculates charge rates and updates all dependent bids, dashboards, and reports.

Charge rates are versioned and time-bound, allowing teams to:

- Reproduce historical bids accurately.

- Compare alternative pricing scenarios.

- Avoid manual spreadsheet recalculations that introduce errors.

By implementing charge rate logic as a system-level calculation service, construction companies and equipment lenders ensure that bidding decisions are based on consistent, explainable, and up-to-date equipment economics rather than fragmented assumptions.

Step #3: Modeling external risks as software parameters and scenarios

External risks such as inflation, interest rate changes, and regulatory updates do not directly affect construction equipment costs. Instead, they influence the assumptions used in cost and charge rate calculations. In a software-based cost management system, these risks should not be addressed through manual adjustments or ad hoc decisions. They must be modeled explicitly as parameters that can be updated, recalculated, and compared across scenarios.

In the system we built, external risk factors were implemented as global economic and regulatory parameters rather than isolated adjustments. These parameters are applied consistently across all equipment, projects, and bids. When a parameter changes, the system automatically recalculates dependent values, including TCO and charge rates, without breaking internal consistency.

This approach allows teams to evaluate the impact of changing conditions before committing to bids or long-term equipment decisions, while preserving traceability of past calculations.

How external risks are represented in the software

| External risk factor | Modeled in the system as | Primary impact |

|---|---|---|

| Inflation | Cost escalation rate | Operating and maintenance costs |

| Interest rate changes | Financing and discount parameters | TCO and capital costs |

| Taxation and depreciation rules | Depreciation schedules and tax parameters | Charge rate structure |

| Regulatory changes | Compliance cost parameters | Operating costs and lifecycle assumptions |

| Supply chain disruptions | Utilization and availability assumptions | Effective cost per hour |

| Technological obsolescence | Residual value and lifecycle duration | Depreciation and replacement timing |

Scenario-based recalculation

Each parameter set can be stored as a scenario snapshot. This allows teams to compare outcomes under different assumptions, such as changes in interest rates or utilization levels, without overwriting baseline data. Historical scenarios remain fixed, ensuring that previous bids and decisions remain explainable and auditable.

By modeling external risks as parameters and scenarios inside the software, construction companies and equipment lenders can respond to uncertainty with speed and confidence, while maintaining a single source of truth for equipment economics.

Step #4: Translating economic requirements into software architecture

Once cost logic, charge rate calculations, and external risk parameters are defined, the next challenge is ensuring that the software architecture can support them reliably over time. In construction equipment cost management, enterprise software architectural decisions are not driven by technology trends, but by economic and operational requirements.

In the system we built, architecture was designed around the behavior of cost calculations rather than around user interface or implementation convenience. The primary requirement was the ability to recalculate equipment economics quickly, consistently, and without breaking historical data when assumptions change.

To achieve this, the system architecture followed several key principles.

Separation of calculation logic

Cost and charge rate calculations were isolated from presentation and workflow logic. This ensured that economic rules could evolve independently of user interfaces, reporting, or integrations, while maintaining a single source of truth for all financial outputs.

Parameter-driven behavior

All critical assumptions-interest rates, depreciation rules, utilization factors, overhead allocation-were externalized as configurable parameters. This allowed finance and operations teams to adjust inputs without changing application code, while preserving consistency across the system.

Versioning and auditability

Every calculation depended on versioned parameters and time-bound rules. This made it possible to reproduce historical bids, explain past decisions, and compare scenarios without overwriting prior results.

Scalability and performance guarantees

Architecture choices were guided by the need to handle large fleets and cascading recalculations. Changes to global parameters were designed to propagate efficiently across thousands of equipment units without degrading system responsiveness.

Integration boundaries

Clear boundaries were defined for integration with ERP systems used in construction, accounting, and planning. The cost management system was designed to both consume financial data and expose calculated charge rates back to enterprise workflows in a controlled and auditable way.

By translating economic requirements directly into architectural principles, the system remained stable, explainable, and adaptable as business conditions changed. This approach ensured that software supported equipment cost decisions over the long term, rather than becoming a constraint as complexity increased.

Step #5: Scaling the system across equipment types and fleet size

Once cost logic, charge rate calculations, and architectural principles are in place, the next challenge is scale. Construction equipment cost management systems must operate reliably across fleets that include many equipment types, diverse configurations, and large volumes of data. Scaling here is not only about performance, but about preserving economic consistency as complexity increases.

In the system we built, scalability was addressed at two levels: economic modeling flexibility and computational efficiency.

From a modeling perspective, the system had to support equipment with very different characteristics-standard machinery, specialized assets, and equipment with unique cost drivers-without duplicating logic or creating exceptions that would undermine consistency. This was achieved by separating shared economic rules from equipment-specific parameters, allowing new equipment types to be introduced without redesigning the calculation model.

From a performance perspective, the system needed to handle cascading recalculations. Changes to global assumptions such as interest rates, utilization factors, or overhead allocation could affect thousands of equipment units simultaneously. The architecture was therefore designed to support batch processing, incremental recalculation, and pre-aggregated results for analytical use, ensuring that updates remained fast even at fleet scale.

Visualization and decision support

As fleet size and model complexity grow, raw numbers become difficult to interpret. For this reason, data visualization was treated as a decision support layer directly connected to the calculation engine rather than a separate reporting tool.

The system provided visual views such as:

- Equipment utilization schedules showing actual and planned usage over time.

- Cost breakdowns by equipment, project, and cost category.

- Charge rate comparisons across scenarios and assumptions.

- Project-level views linking equipment economics to bid outcomes.

Because visualizations were generated from the same calculation logic used for charge rates and bids, decision-makers could trust that charts and dashboards reflected the current economic state of the system rather than outdated snapshots.

By combining flexible economic modeling with scalable calculation and integrated visualization, the system remained usable and reliable as fleet size, equipment diversity, and decision complexity increased.

Step #6: Ensuring high system performance for efficient calculations

When managing a large fleet of construction equipment, it’s crucial to have a system that can handle changes in calculations quickly and efficiently. For example, when updating a general parameter like interest rates, the change will affect all equipment pieces within the fleet.

With potentially thousands of equipment pieces and various sheets and charts in the system, these calculations could take a significant amount of time. To prevent delays and maintain smooth operations, it’s essential to ensure that the system performance is consistently high. This allows for timely adjustments and adaptations, ultimately leading to more effective equipment cost management.

Supporting features for construction equipment cost management systems

Beyond core cost modeling, charge rate calculation, and system architecture, practical equipment cost management systems often include supporting features that streamline daily operations and improve decision execution. These features do not define the system’s economic logic, but they help teams apply it consistently across bidding, planning, and analysis workflows.

Typical supporting features include:

- Bid log and analysis tools – centralized tracking of submitted bids with visibility into assumed charge rates, utilization parameters, and scenario inputs used during pricing.

- Job and project analysis workbooks – structured views that link equipment usage, costs, and outcomes to completed projects, enabling post-project analysis and continuous improvement.

- Cost breakdown structures – standardized mappings that connect equipment costs to projects, cost centers, and accounting categories for clearer financial reporting.

- Discount and adjustment worksheets – controlled mechanisms for applying discounts or pricing adjustments while preserving transparency of underlying cost assumptions.

- Pre-job checklists and planning artifacts – templates that ensure required economic inputs, assumptions, and approvals are in place before bids or execution decisions are finalized.

When implemented inside the system rather than as disconnected spreadsheets, these features help maintain data consistency, reduce manual errors, and ensure that operational workflows remain aligned with the underlying cost logic.

Why this system description is grounded in real delivery

The approach described in this article is based on SumatoSoft’s practical experience building construction equipment cost management systems for real clients. When developing such platforms, we apply the same steps outlined above: modeling equipment economics explicitly, implementing charge rate calculations as software logic, handling external risks through parameters and scenarios, and designing architecture around recalculation, scale, and auditability.

In our projects, construction equipment cost management is treated as an economic software system, not a collection of spreadsheets or disconnected tools. This requires deep work across data modeling, calculation logic, performance optimization, visualization, and integration with enterprise processes. The focus is always on making cost assumptions transparent, explainable, and adaptable as conditions change.

SumatoSoft specializes in building custom enterprise software where economic logic, data consistency, and long-term maintainability matter. Our experience in IoT development, data-intensive platforms, and enterprise software development informs how we design systems that operate reliably at scale and remain usable as business requirements evolve. This is the perspective that shaped the system design principles described throughout this article.

Summary

In this article, we described how construction equipment cost management can be implemented as a software system built around equipment economics, rather than as a set of disconnected tools or spreadsheets. We showed how Total Cost of Ownership (TCO) becomes a calculation layer in software, how charge rates are derived from configurable economic inputs, and how external risks are modeled as parameters and scenarios instead of manual adjustments.

We also explained how these economic requirements translate into software architecture decisions, enabling scalable recalculation, auditability, and consistency across large and diverse equipment fleets. By separating cost logic from presentation, supporting scenario-based analysis, and integrating visualization directly with calculation engines, such systems allow teams to make pricing and planning decisions with greater confidence.

Following this approach, construction companies and equipment lenders can build equipment cost management platforms that remain accurate, explainable, and adaptable as assumptions change, supporting reliable bidding, long-term equipment planning, and sustainable profitability.

Let’s start

If you have any questions, email us info@sumatosoft.com