Fintech software development services

At the intersection of innovation and expertise, SumatoSoft develops secure, high-performance fintech software that keeps you ahead of changing markets, strict regulations, and rising customer expectations.

Our fintech software development services

SumatoSoft builds reliable, compliant fintech software. With over a decade of experience in the fintech software development services market, we deliver modern and secure fintech solutions like payment apps, digital wallets, and wealth management tools for startups and enterprises.

Consulting & discovery

We analyze your goals, technical needs, and compliance requirements (e.g., GDPR, PCI DSS, KYC/AML) to define a clear project scope. You receive a practical timeline and budget with risk planning to avoid surprises and ensure a smooth start.

Example: Crafted a roadmap for a European payment platform, launched on schedule.

UX/UI & system architecture

As part of our development services, we create intuitive interfaces for financial apps, optimized for mobile and desktop users. Our architects build scalable systems to handle high transaction volumes securely. This ensures your platform is easy to use and reliable.

Example: Design a user-friendly digital wallet for a fintech startup.

Custom development

We write secure, high-quality code that meets banking-grade security standards. Using agile sprints, we deliver testable features regularly, keeping you informed and speeding up market entry.

Example: Built a robo-advisor platform for a wealthtech Client, ready in months.

Integration

We connect your platform to banking cores, payment gateways (e.g., Stripe, PayPal), or third-party APIs. Secure data flow reduces manual work and boosts service speed.

Example: Integrated a payment system for a bank, improving transaction efficiency.

Quality assurance

Quality assurance is an essential part of our services. We run automated and manual tests to ensure functionality, security, and compliance. Stress testing confirms stability under load, delivering a product that meets regulations.

Result: Thorough testing ensured a Client’s app passed compliance audits smoothly.

Post-launch support

We monitor performance, fix bugs, and apply security updates promptly. Post-launch support services imply ongoing enhancements that keep your platform competitive, protecting your investment.

Focus: Provided continuous support for a digital banking app to maintain uptime.

Our core offerings

We build FinTech solutions that help companies launch new products faster, automate operations, secure transactions, and comply with regulations – all while delivering a superior digital experience to users. Below are examples of our custom software development services for banks, startups, insurance providers, and other financial organizations.

Client applications

We design secure web and mobile apps that give customers full control over their finances, anytime, anywhere. The apps we created during our FinTech development services increase user engagement, reduce branch visits, and enable 24/7 financial operations from any device. They combine intuitive UX, robust security, and seamless integration with your core banking or payment systems:

Transaction & processing systems

We develop back-end systems that process high-volume financial operations accurately and fast, tailored for each business model. They ensure high transaction throughput, automate routine tasks, minimize manual errors in financial workflows, provide reliable real-time processing, support regulatory reporting, and scale effortlessly with your transaction volumes:

Peer-to-peer & marketplace platforms

We create platforms that connect users, businesses, or investors, automating complex multi-party transactions securely. These FinTech solutions open new revenue streams by directly linking service providers and customers while reducing intermediaries. The financial software we develop handles identity checks, funds flow, and dispute resolution, giving users trust and transparency in every deal:

Risk & compliance solutions

We build tools that detect fraud in real time and ensure operations meet all regulatory standards. These FinTech solutions protect reputation and finances by flagging suspicious activity instantly and supporting audits effortlessly. As a part of our development services, we integrate this financial software with your existing systems to monitor transactions, flag suspicious patterns, and generate compliance reports:

Intelligent automation & advisors

We implement AI-powered components that reduce manual work and deliver personalized service. They help companies cut operational costs and serve thousands of users simultaneously with consistent quality. Such systems learn from user behavior and financial data to automate repetitive tasks and offer tailored recommendations:

Client applications

We design secure web and mobile apps that give customers full control over their finances, anytime, anywhere. The apps we created during our FinTech development services increase user engagement, reduce branch visits, and enable 24/7 financial operations from any device. They combine intuitive UX, robust security, and seamless integration with your core banking or payment systems:

Transaction & processing systems

We develop back-end systems that process high-volume financial operations accurately and fast, tailored for each business model. They ensure high transaction throughput, automate routine tasks, minimize manual errors in financial workflows, provide reliable real-time processing, support regulatory reporting, and scale effortlessly with your transaction volumes:

Peer-to-peer & marketplace platforms

We create platforms that connect users, businesses, or investors, automating complex multi-party transactions securely. These FinTech solutions open new revenue streams by directly linking service providers and customers while reducing intermediaries. The financial software we develop handles identity checks, funds flow, and dispute resolution, giving users trust and transparency in every deal:

Risk & compliance solutions

We build tools that detect fraud in real time and ensure operations meet all regulatory standards. These FinTech solutions protect reputation and finances by flagging suspicious activity instantly and supporting audits effortlessly. As a part of our development services, we integrate this financial software with your existing systems to monitor transactions, flag suspicious patterns, and generate compliance reports:

Intelligent automation & advisors

We implement AI-powered components that reduce manual work and deliver personalized service. They help companies cut operational costs and serve thousands of users simultaneously with consistent quality. Such systems learn from user behavior and financial data to automate repetitive tasks and offer tailored recommendations:

Data & analytics platforms

As a fintech software development company, we provide advanced analytics FinTech solutions that extract insights to boost profitability and decision-making. They transform raw data into clear dashboards and forecasts, helping executives act on trends quickly and confidently. Our services allow us to unify fragmented financial data into one source of truth and provide dashboards for real-time tracking and forecasting:

Customer relationship management (CRM)

We offer centralized tools to manage customer interactions and personalize financial services. They improve customer retention by tracking preferences, automating follow-ups, and targeting offers effectively. We develop FinTech software solutions that store complete customer profiles, track interactions across channels, and help teams deliver proactive, relevant service:

Collaboration & partner portals

We build digital workspaces for staff, agents, and partners to share information securely and coordinate faster. They speed up approvals, standardize communication, and keep distributed teams aligned on shared goals. They streamline document sharing, approval workflows, and partner onboarding within a single protected environment:

Crypto & digital asset solutions

We develop blockchain-based tools for managing digital currencies and tokenized assets. They enable instant, secure, and transparent transactions while opening opportunities for new digital revenue channels. They handle secure key storage, real-time transaction tracking, and compliance with evolving crypto regulations:

Data & analytics platforms

As a fintech software development company, we provide advanced analytics FinTech solutions that extract insights to boost profitability and decision-making. They transform raw data into clear dashboards and forecasts, helping executives act on trends quickly and confidently. Our services allow us to unify fragmented financial data into one source of truth and provide dashboards for real-time tracking and forecasting:

Customer relationship management (CRM)

We offer centralized tools to manage customer interactions and personalize financial services. They improve customer retention by tracking preferences, automating follow-ups, and targeting offers effectively. We develop FinTech software solutions that store complete customer profiles, track interactions across channels, and help teams deliver proactive, relevant service:

Collaboration & partner portals

We build digital workspaces for staff, agents, and partners to share information securely and coordinate faster. They speed up approvals, standardize communication, and keep distributed teams aligned on shared goals. They streamline document sharing, approval workflows, and partner onboarding within a single protected environment:

Crypto & digital asset solutions

We develop blockchain-based tools for managing digital currencies and tokenized assets. They enable instant, secure, and transparent transactions while opening opportunities for new digital revenue channels. They handle secure key storage, real-time transaction tracking, and compliance with evolving crypto regulations:

Unlock your FinTech vision.

Start building the financial future you envision today.

How different BFSI sectors leverage fintech software

Our custom FinTech solutions help every segment of the banking, financial services, and insurance (BFSI) sector boost efficiency, cut costs, and deliver a secure, digital-first customer experience. Here’s how each sector benefits from our FinTech development services:

Banking

- 24/7 self-service through user-friendly mobile and web banking apps;

- faster service delivery by automating core banking operations end-to-end;

accurate, secure transactions with integrated open banking APIs; - paperless banking enabled by fully digital neobanking platforms.

Payments

- instant, secure payments via custom and third-party gateways;

- seamless user experience with popular options like QR code scans, NFC payments, and peer-to-peer transfers;

- cryptocurrency support for domestic and international payments secured by blockchain.

Lending

- rapid risk scoring and loan decisioning with AI-powered models;

- smart loan pricing compliant with current regulations;

- automated collections and debt recovery workflows to reduce defaults;

- P2P lending platforms that connect borrowers and investors directly, cutting out intermediaries.

Mortgage

- streamlined applications and fee calculation with automation;

- AI-driven collateral valuation and real-time risk monitoring;

- fully digital closing, servicing, and foreclosure workflows;

- secure digital storage for large mortgage document archives;

- live borrower data pulled via API for ongoing performance tracking.

Insurance

- data-driven underwriting and dynamic risk pricing;

- automated actuarial processes to speed up policy development;

- fast claim resolution with real-time capture and smart validation;

- multi-role portals for better collaboration among agents, Clients, and vendors;

- next-gen models like parametric or usage-based insurance powered by IoT integrations.

Financing

- lower fees with AI advice on optimal loan terms and repayment periods;

- automated charge and commission calculations for accuracy and transparency;

- accessible funding through P2P and crowdfunding platforms;

- secure blockchain-based financing including ICOs and STOs.

Investment & wealth management

- smarter investment decisions driven by AI portfolio insights;

- automated trading for instant transaction execution and confirmations;

- reduced risks thanks to precise earnings forecasts and hedge recommendations.

Decentralized finance (DeFi)

- trustless transactions handled securely by blockchain without intermediaries;

- automated execution using smart contracts for transparency and speed;

- global reach with borderless processing of financial operations.

Corporate finance management

- no more manual grunt work — automate bookkeeping, billing, and reporting;

- real-time visibility into company-wide financial activities;

- deep financial analytics enhanced by AI for better strategic planning.

Who we help to develop fintech software

SumatoSoft provides fintech software development services for a wide range of businesses. We serve three distinct groups, each with unique needs. Here’s how we deliver fintech solutions that fit.

Traditional finance

Banks, credit unions, savings and loan associations, cooperative banks.

We create secure banking apps and loan platforms that are easy to use and fully compliant, keeping your operations smooth and your customers confident. Your customers demand secure, reliable services that meet PCI DSS and KYC/AML rules, while outdated systems need upgrades to stay competitive. Our fintech software development services include both secure software development and full regulatory compliance.

Specialized finance

Insurance companies, wealth management firms, investment advisory firms, pension funds.

We build user-friendly claims portals for insurers and custom analytics tools for wealth managers, saving time and giving your Clients clear, actionable insights. You focus on efficiency and empowering Clients. Faster claims processing or tools like robo-advisors help Clients make smart decisions. That’s where our FinTech software development expertise comes in, turning complex workflows into secure, easy-to-use digital solutions that build trust and drive growth.

FinTech and non-financial enterprises

FinTech startups, retail chains, e-commerce platforms, healthcare providers, telehealth services, logistics companies, education platforms.

We deliver scalable digital wallets for startups and seamless integrations for others, getting you to market quickly with systems that work with your existing tools. You prioritize speed and flexibility. Startups need payment or lending platforms launched fast, while retail, healthcare, logistics, or education businesses want finance features like payment processing woven into their products. Our FinTech development services allow these businesses to reach their goals.

Traditional finance

Banks, credit unions, savings and loan associations, cooperative banks.

We create secure banking apps and loan platforms that are easy to use and fully compliant, keeping your operations smooth and your customers confident. Your customers demand secure, reliable services that meet PCI DSS and KYC/AML rules, while outdated systems need upgrades to stay competitive. Our fintech software development services include both secure software development and full regulatory compliance.

Specialized finance

Insurance companies, wealth management firms, investment advisory firms, pension funds.

We build user-friendly claims portals for insurers and custom analytics tools for wealth managers, saving time and giving your Clients clear, actionable insights. You focus on efficiency and empowering Clients. Faster claims processing or tools like robo-advisors help Clients make smart decisions. That’s where our FinTech software development expertise comes in, turning complex workflows into secure, easy-to-use digital solutions that build trust and drive growth.

FinTech and non-financial

FinTech startups, retail chains, e-commerce platforms, healthcare providers, telehealth services, logistics companies, education platforms.

We deliver scalable digital wallets for startups and seamless integrations for others, getting you to market quickly with systems that work with your existing tools. You prioritize speed and flexibility. Startups need payment or lending platforms launched fast, while retail, healthcare, logistics, or education businesses want finance features like payment processing woven into their products. Our FinTech development services allow these businesses to reach their goals.

Industry-specific fintech solutions

We craft financial software that aligns with real workflows, strict compliance, and evolving Client expectations. Each fintech solution is built from scratch – tested, secure, and ready for heavy use.

Banking software

From core banking engines to mobile-first apps, we act as a reliable banking software development company, helping banks modernize their software without downtime. Clients get secure, round-the-clock access to services, and banks cut manual paperwork and maintain tight control over sensitive data. Digital banking becomes more than a channel – it becomes your main touchpoint.

Payment processing systems

Reliability is everything when money moves. Our payment platforms manage high-volume card transactions, integrate digital wallets, and support cross-border settlements with full transparency and instant confirmations. Businesses process funds faster, while Clients enjoy smooth, secure payments anywhere.

Trading & investment platforms

We know traders and investors demand instant insights. Our platforms deliver real-time data feeds, sharp analytics, and tools for fast execution, whether for stocks, crypto, or complex portfolios. Smart automation takes care of routine steps so Clients stay focused on strategy.

Financial management & accounting software

Keep finances clear and audit-ready without drowning in spreadsheets. As a part of our fintech development services, we build systems that handle budgets, automate accounting tasks, and generate reliable reports. Teams work with up-to-date data and spend less time fixing manual errors for Clients.

Risk management & compliance solutions

Staying compliant and catching fraud shouldn’t slow operations down. Our fintech solutions spot anomalies in transactions within milliseconds, automate KYC/AML checks, and provide easy-to-read compliance reports. You reduce exposure while meeting every standard, from PCI DSS to PSD2, for Client security.

Insurance software

Serving policyholders well means moving fast and staying accurate. We create digital tools for policy tracking, automated underwriting, and claims processing, plus Client portals for instant updates. Insurers see fewer errors, faster turnaround times, and higher Client trust.

Revolutionize your financial services.

Get a free consultation to transform your operations.

Reliable tech & tools to develop fintech solutions

Languages & core frameworks

Ruby, Python, Node.js, Elixir, Java, SQL, PHP, JavaScript, TypeScript, C#, Ruby on Rails, Grape, Gatsby, Sinatra, Express.js, Microsoft .NET, Flask, Spring/Hibernate, Laravel/WordPress

Client-side & frontend

ReactJS, Vue.js, Next.js, Angular, Gatsby, Bootstrap, Custom JavaScript, Django, jQuery, MeteorJS

Databases & storage

MySQL, PostgreSQL, MongoDB, Redis, AWS DynamoDB, AWS RDS, AWS S3, Microsoft SQL Server

Cloud & infrastructure

AWS, Microsoft Azure, Google Cloud Platform, Docker, Kubernetes

BI, analytics & big data

Tableau, Power BI, JasperReports, JasperServer, Firebase Crashlytics, Google Analytics, BIRT, Pentaho, Talend, Graphite, Apache Kafka, Apache Hadoop

Artificial intelligence & machine learning

PyTorch, OpenAI API, GPTs, Tesseract OCR

Mobile development

Swift (iOS), Kotlin (Android), React Native

Internet of Things (IoT)

AWS IoT Core, Azure IoT Hub, Google Cloud Platform, Apache Kafka, Apache Hadoop, Amazon DynamoDB, Amazon S3, Azure Cosmos DB

Tomorrow’s finance: our response to emerging trends

Financial services never stand still – and neither do we. At SumatoSoft, we watch what’s next, test new technologies early, and craft fintech solutions that help you adapt faster than your competition. We constantly adjust our fintech software development services to maximize the value of our Clients.

We don’t just follow fintech trends – we turn them into practical tools that help you lead.

Here’s how we prepare your business for the finance of tomorrow:

Blockchain

Trust and transparency are non-negotiable in finance. Blockchain makes transactions tamper-proof and traceable. We apply it to build secure payment systems, automate agreements through smart contracts, and enable fast, transparent cross-border transfers, cutting fraud and hidden costs along the way.

Artificial intelligence and machine learning

AI and ML push financial operations from reactive to predictive. We embed them in fraud detection engines that learn from new threats, smart scoring tools that assess risk in real time, and virtual assistants that give customers instant, human-like help, delivering smarter tech, safer transactions, and happier Clients.

Lending automation

Borrowers expect fast answers; lenders need accuracy and compliance. Our lending automation takes care of routine checks, verifies data instantly, and speeds up approvals, ensuring fewer errors, faster funding, and a lending process that scales with demand.

Regulatory technology (RegTech)

Regulations tighten every year, but compliance shouldn’t slow you down. We build RegTech tools that monitor new rules, automate reporting, and keep your systems audit-ready, reducing surprises, lowering compliance costs, and freeing up time for strategy.

Digital payments and mobile wallets

As cash fades, digital payments must be fast and secure – everywhere. We develop systems and wallets that handle tap-and-go cards, QR codes at the checkout, and crypto payments for next-gen customers, keeping each transaction protected and frictionless.

Sustainable & socially responsible investing (SRI)

Modern investors want returns and impact. We design SRI platforms that let users choose green and ethical assets, track real-world impact, and balance profit with purpose, connecting your brand with a growing community of responsible investors.

Why SumatoSoft?

- Uncompromising security & compliance. Protecting sensitive data isn’t an add-on – it’s our starting point. We follow top cybersecurity standards and hold ISO/IEC 27001 certification for information security management. Every fintech solution is stress-tested, encrypted end-to-end, and built to comply with financial regulations like PCI DSS, GDPR, and KYC/AML from day one.

- Expert team & quality assurance. More than 70% of our engineers are senior-level professionals with deep domain expertise. We stick to industry best practices, run frequent code reviews, and refine skills through ongoing training. Agile processes and clear reporting mean you get clean, scalable code – and no surprises. With 13+ years in fintech app development services, we stand as a trusted technology partner you can rely on.

- Rapid delivery & MVP launches. In fintech, speed to market can define who leads. Our teams deliver fully working MVPs in about three months – ready to process, store, analyze, and present financial data securely. Frequent releases and flexible scaling help you test ideas early, adjust fast, and stay ahead of user needs and investors’ expectations.

- Proven track record. Numbers back our promises. We’ve built 250+ custom systems in over 25 countries, with many Clients staying with us for years. From global banks to agile fintech startups, companies trust us because we deliver – and our 98% satisfaction rate shows we do it consistently, on time and on budget.

Streamline your finances and operations.

Discover custom fintech solutions that boost your ROI.

Success stories of our Clients

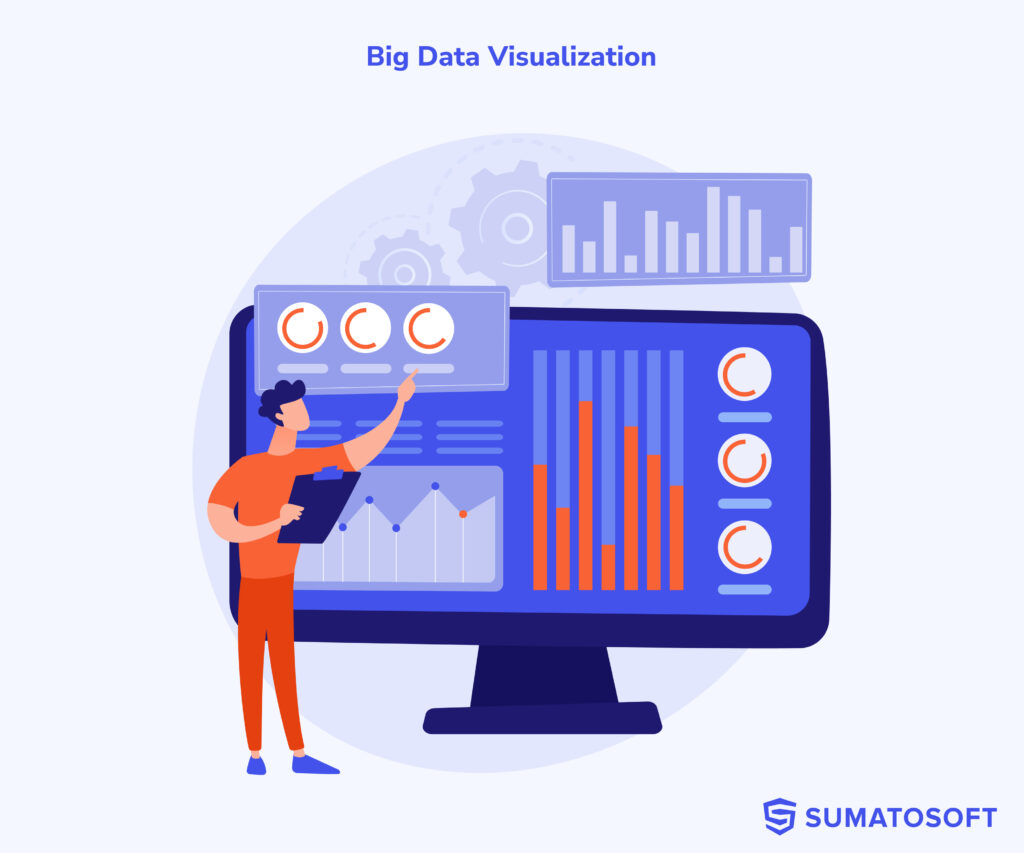

Innovative big data trading platform

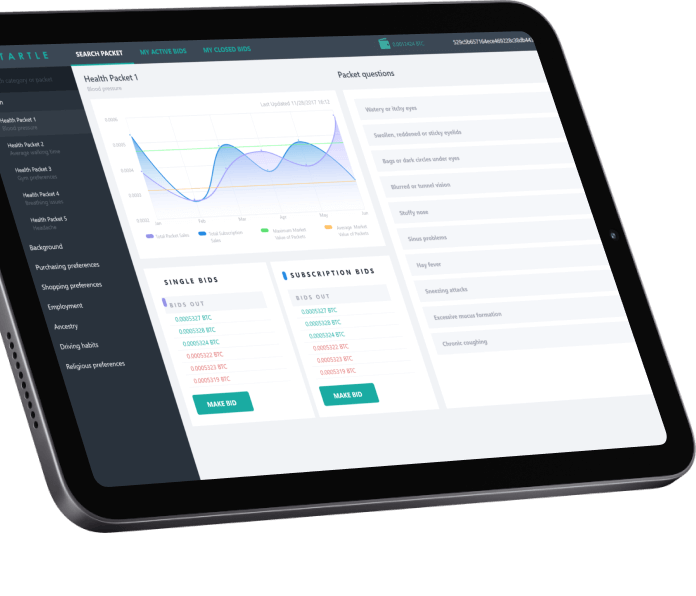

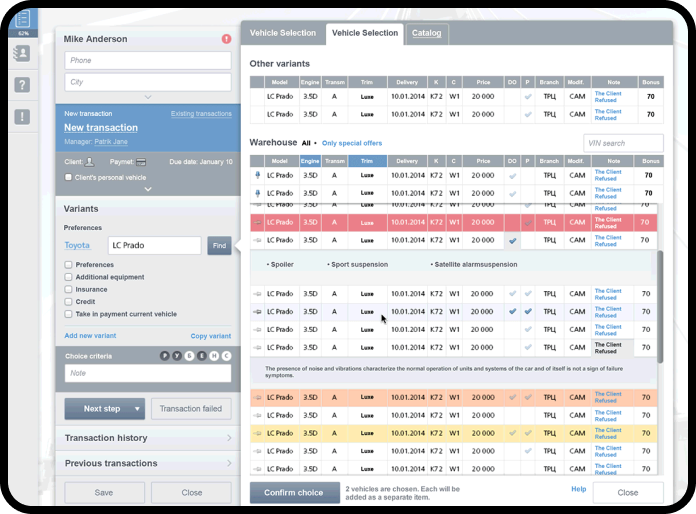

Custom ERP system for Toyota car dealer

Flat rate price book app

Our streamlined fintech development process

Our development process balances speed, transparency, and strict quality control – so you get secure fintech software without delays or surprises. Here’s what working with us on fintech software development looks like:

Every fintech project starts with clear questions: What are your goals? Who will use it? What regulations apply? We turn these answers into realistic timelines, cost estimates, and a step-by-step plan that everyone can trust.

Next, we sketch how everything fits together. Architects lay out a secure, scalable financial software system, while designers craft user flows that feel effortless – all with compliance built in from the first wireframe.

Instead of one big release, we build the fintech software in short sprints. You get working features to review every 2–4 weeks, plus updates through CI/CD pipelines to catch bugs early and keep progress visible.

No shortcuts here. Each release goes through automated checks and manual tests for functionality, security, and regulatory compliance of your financial software. The goal: zero critical issues, every time.

We deploy safely to your servers or cloud of choice and connect new financial software to your existing cores, payment gateways, or other systems – all without disrupting daily operations.

Going live is just the start. We stay on hand to monitor performance, push updates, and add new features as your business grows – so your fintech solution stays secure and competitive long-term.

Innovate your financial offering.

Get a tailored development quote for your unique needs.

See how you benefit from partnering with us

Our experience proves that flexibility is essential to meeting each Client’s fintech goals – without surprises in timeline or budget. Here’s how you gain real value working with us:

Flexible cooperation models

Choose the best setup for your project’s scale and speed:

- full outsourcing of your custom fintech software development;

- a dedicated team to handle part of your project;

- team augmentation with top specialists – from 1 expert to 50+ FTEs that join your project.

Flexible pricing options

Select a payment model that matches your financial planning for the fintech project:

- time & materials (T&M) or T&M with a cap – ideal for advisory or agile delivery of financial software;

- fixed price – when work is split into clearly defined stages with a pre-agreed price for every step;

- yearly subscription – for fintech projects that require ongoing support and maintenance.

Flexible development pace

Adapt delivery speed to your business priorities:

- kickoff in 1–2 weeks;

- MVP in 3+ months;

- new releases every 2 weeks;

- on-demand team scaling to accelerate delivery when needed.

Flexibility to embrace change

We make pivots simple:

- clear change request processes for controlled, fast implementation;

- adjustable collaboration style and communication frequency – tuned to your workflow and comfort level.

What never changes in our services

While our cooperation is flexible, our core principles stay solid to guarantee smooth delivery and top-tier results for every fintech project:

Risk-free delivery

Accurate time and cost estimates, proactive risk planning, and clear feasibility checks ensure you never get unpleasant surprises. Need extra confidence? We’ll build a proof of concept to test your idea in the real world.

Full transparency

Joint scoping, open discussion of benefits and risks, KPI-based progress reports, and clear documentation – so you always know where your financial software project stands.

Built-in compliance

We guarantee alignment with global and local regulations for your financial software, including AML/KYC, PCI DSS, IFRS, CCPA, CCAR, FINRA, GLBA, FCRA, FCBA, SOX, SOC 1 & SOC 2, GDPR, PSD2 (EU), SAMA (KSA), NYDFS (New York), and more.

Security by design

From fraud detection and encryption to biometric authentication and infrastructure monitoring – we build multiple layers of protection into your fintech solution from day one.

Get started with your project

Working with SumatoSoft is simple and clear:

Your project starts here.

We’re ready to sign NDA

RFP analysis is absolutely free

We will respond to you within 24 hours

Frequently asked questions

What is fintech software development?

It’s how digital tools for finance are planned, built, and improved. Payments, lending, trading, and risk control all rely on this software working securely and fast. Behind every smooth transaction is code built to handle strict rules and protect users’ money.

What does a fintech software engineer do?

They write and test the code that keeps banking apps, payment systems, and trading platforms running safely. A big part of their job is guarding sensitive data and making sure every feature follows financial laws. In short: they build trust into every line of code.

What software is used in fintech?

Typical stacks include Java, Python, Ruby, JavaScript, and frameworks like .NET or React. Cloud platforms (AWS, Azure), secure databases (PostgreSQL, MongoDB), and open banking APIs tie everything together. Teams pick what fits each project’s security and speed goals best.

What are the 5 D’s of fintech?

They explain how finance is changing:

- digitization – putting services online;

- disintermediation – fewer middlemen;

- democratization – more people can use them;

- decentralization – blockchain-based systems;

- datafication – turning transactions into insights.

Together, these ideas push banks and startups to reinvent how money moves.