Predictive Analytics in Finance: Challenges, Benefits, Use Cases

Imagine a tool so powerful it can foresee market trends, outsmart fraud, and personalize customer experiences before they even express a need. Welcome to the realm of predictive analytics in finance, where foresight is the new currency.

The term “predictive analytics” itself is a relatively modern descriptor for a set of statistical and analytical techniques that have been developing over decades if not centuries.

The roots of predictive analytics can be traced back to the early 20th century with the development of statistical modeling in the form of regression analysis, bayesian statistics, time series analysis and the later advancement of mainframe computers from IBM and the Seven Dwarfs or NCR, which made complex calculations more feasible for businesses.

We at SumatoSoft, took up the torch in the development of this technology by providing financial software development services with a focus on data analytics software. Here, I’m sharing not only my own insights but also the collective expertise of all the colleagues I work with.

Modern Finance Landscape: Overview

Before speaking about predictive analytics, I want to clarify the types of organizations that stand behind the term “Finance” and the key challenges they face.

Finance, as a broad sector, encompasses a wide range of activities related to the management of money and investments. It includes banking, insurance, investment, and financial planning, among other areas.

Organizations within the finance sector can vary widely, from commercial and investment banks to insurance companies, investment funds, credit unions, and fintech startups. The sector also includes regulatory bodies and financial markets, such as stock exchanges.

The financial landscape is marked by a diverse array of organizations, each with distinct functions and goals. Yet, it is their common challenges that unify them.

The finance sector faces several significant challenges and pain points, which can vary among different types of organizations within the sector.

General Challenges in Finance

#1 Regulatory Compliance and Changes

Financial institutions must adhere to a complex web of regulations designed to ensure stability, protect consumers, and prevent financial crimes. Examples include the Basel III regulations for bank capital adequacy, the Dodd-Frank Act in the United States for financial reform, and the General Data Protection Regulation (GDPR) in the European Union for data privacy. Compliance with these and other regulations requires extensive legal expertise, robust reporting systems, and constant vigilance to adapt to new legislative changes, making it a substantial operational burden.

#2 Fraud and Security Threats

The digitalization of financial services has led to sophisticated cyber threats, including phishing attacks, identity theft, and ransomware. An example is the increasing incidence of social engineering fraud, where attackers manipulate individuals into divulging confidential or personal information. Failure to adequately protect against these threats can result in significant financial losses, erosion of customer trust, and regulatory penalties.

#3 Market Volatility and Risk Management

Market volatility can be triggered by various factors, including economic indicators, geopolitical events, and natural disasters. Investment firms and hedge funds use strategies like diversification, asset allocation, and hedging to manage these risks. However, the unpredictable nature of global markets makes it challenging to mitigate losses and capitalize on opportunities effectively.

#4 Technological Disruption and Innovation

The rise of fintech companies utilizing blockchain for secure transactions, artificial intelligence for personalized financial advice, and robo-advisors for automated investment services illustrates the pace of innovation. Traditional banks and financial institutions must invest in similar technologies to remain competitive but face challenges integrating new solutions with legacy systems while ensuring regulatory compliance.

#5 Customer Expectations and Experience

Today’s consumers expect seamless, omnichannel access to financial services, personalized advice, and real-time responses to inquiries. For instance, mobile banking apps now offer features like remote deposit capture and instant payments. Meeting these expectations demands significant investment in customer relationship management (CRM) systems, user experience (UX) design, and backend technologies that support these features.

#6 Credit Risk and Loan Defaults

For lending institutions, assessing credit risk accurately and managing loan defaults are critical challenges, especially in uncertain economic conditions.

Lending institutions rely on credit scoring models to evaluate the risk of loan defaults. The unpredictability of economic conditions, as seen in the 2008 financial crisis, can lead to increased loan defaults, impacting the financial health of these institutions.

#7 Operational Efficiency

Financial institutions are under constant pressure to reduce operational costs while enhancing service quality. This involves automating routine processes with technologies like robotic process automation (RPA) and optimizing workflows to reduce manual interventions, which can be costly and error-prone.

#8 Interest Rate and Liquidity Risk

Fluctuating interest rates affect the profitability of banks’ loan and investment portfolios. For example, when interest rates rise, the value of fixed-income securities tends to fall, and borrowing costs can increase. Managing this risk requires sophisticated financial modeling and strategies such as duration matching and gap analysis.

#9 Environmental, Social, and Governance (ESG) Pressures

Investors and regulators increasingly demand that financial institutions consider the sustainability and ethical impact of their investments. This includes avoiding investments in industries harmful to the environment and supporting projects that contribute to social welfare. The challenge lies in integrating ESG criteria into investment decision-making processes without compromising financial returns.

Alright, we’re wrapping up the finance section. Keeping challenges in mind, I want to move on to the tool that can help address these challenges. This tool is predictive analytics.

What is Predictive Analytics in Finance

Predictive analytics in finance harnesses statistical techniques, machine learning algorithms, and data analysis to forecast future financial events based on historical and current data. This advanced analytical approach enables financial institutions and investors to make more informed decisions by predicting:

- stock market movements;

- credit events;

- economic indicators like GDP growth rates, unemployment rate, inflation rate, etc.;

- commodity prices;

- foreign exchange rates;

- real estate market trends;

- interest rates and bond yields,

- regulatory changes and political events;

- financial risks.

And the list goes on. The idea behind using predictive analytics in finance lies in its ability to forecast these events to some extent, allowing companies and individual investors to adapt their strategies and mitigate potential risks.

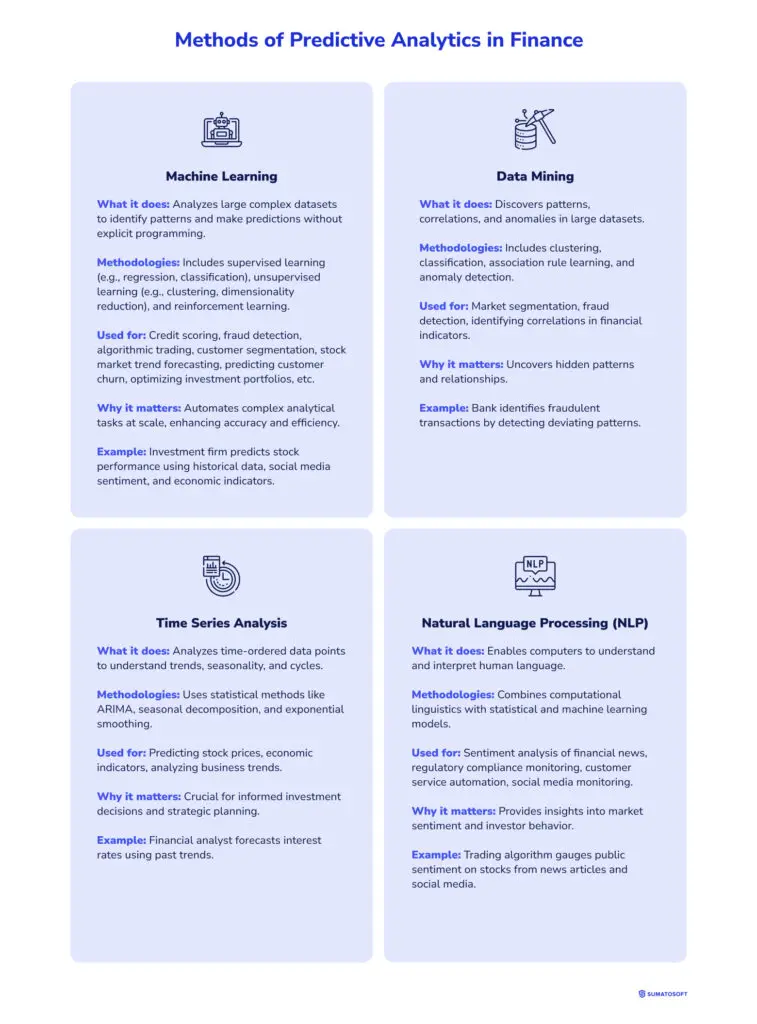

Methods of Predictive Analytics in Finance

Below, we break down the core components of predictive analytics in finance:

Predictive analytics involves extracting information from data using modern technologies and tools. Key methods and technologies include:

Machine Learning

| What it does | Machine learning algorithms analyze large complex data sets to identify patterns and make predictions based on those patterns without being explicitly programmed for specific tasks. It’s the most broad and multipurpose tool for data analysis. |

| Methodologies | Machine Learning encompasses a wide range of algorithms, from supervised learning (like regression and classification) to unsupervised learning (like clustering and dimensionality reduction) and reinforcement learning. Techniques are chosen based on the nature of the prediction problem and the type of data. |

| What it’s used for | It’s utilized for credit scoring, fraud detection, algorithmic trading, customer segmentation, forecasting stock market trends, predicting customer churn, optimizing investment portfolios, and more. |

| Why it matters | Machine learning enables the automation of complex analytical tasks at scale, significantly enhancing the accuracy and efficiency of financial predictions and analysis. |

| Example of Machine Learning in Finance | An investment firm uses machine learning to develop models that predict stock performance based on historical data, social media sentiment, and economic indicators. |

Data Mining

| What it does | Data mining involves discovering patterns, correlations, and anomalies in large data sets at the intersection of machine learning, statistics, and database systems. |

| Methodologies | It involves a variety of techniques, including clustering (finding groups of similar items), classification (predicting item classes), association rule learning (discovering interesting relations between variables), and anomaly detection (identifying outliers). |

| What it’s used for | It’s used for market segmentation, fraud detection, and identifying correlations between different financial indicators. |

| Why it matters | Data mining uncovers hidden patterns and inearths relationships between different financial indicators and outcomes. |

| Example of Data Mining in Finance | A bank employs data mining techniques to identify fraudulent transactions by detecting patterns that deviate from typical user behavior or segment customers based on their purchasing behaviors. |

Time Series Analysis

| What it does | This statistical technique analyzes time-ordered data points to understand patterns such as trends, seasonality, and cycles within time-ordered data points. |

| Methodologies | It employs statistical methods to model and forecast data points based on historical trends. Techniques include ARIMA (AutoRegressive Integrated Moving Average), seasonal decomposition, and exponential smoothing. |

| What it’s used for | It’s primarily used for predicting future stock prices, economic indicator forecasting, and analyzing business trends over time. Its strength lies in analyzing data where temporal sequencing and time-dependent structure are critical. |

| Why it matters | Time series analysis is crucial for making informed investment decisions and strategic planning by understanding temporal trends. |

| Example of Time Series Analysis in Finance | A financial analyst uses time series analysis to forecast future interest rates based on past trends, aiding in mortgage rate predictions. |

Natural Language Processing (NLP)

| What it does | NLP enables computers to understand, interpret, and produce human language, including the contextual nuances of text data. |

| Methodologies | NLP combines computational linguistics—rule-based modeling of human language—with statistical, machine learning, and deep learning models. It encompasses tasks such as sentiment analysis, entity recognition, machine translation, and topic classification. |

| What it’s used for | It’s used for sentiment analysis of financial news, regulatory compliance monitoring (by analyzing legal and regulatory documents), customer service automation through chatbots, automated report generation, and social media monitoring for market sentiment. |

| Why it matters | NLP bridges the gap between human communication and digital data, providing deep insights into market sentiment and investor behavior. |

| Example of NLP in Finance | A trading algorithm uses NLP to scan news articles and social media posts to gauge public sentiment on certain stocks, adjusting its trading strategy accordingly. |

It is the data that all these technologies have in common.

Data Sets That Empower Predictive Analytics

- Historical financial data. This includes stock prices, trading volumes, and financial statements. Analyzing historical trends is foundational for forecasting future financial performances.

- Market trends. Broad market indicators, such as indices performance, inflation rates, and economic growth rates, provide context for predictive models, helping analysts understand the bigger economic picture.

- Customer behavior data. For financial institutions, data on customer transactions, account holdings, and interaction patterns can predict future customer behavior, such as the likelihood of a loan default or the potential for cross-selling financial products.

- Sentiment data. Extracted from financial news, analyst reports, and social media, sentiment data can indicate market sentiment and potential movements. By analyzing the tone and sentiment of current news and reports, predictive models can incorporate the impact of public perception on market dynamics.

- Alternative data. This can include anything from satellite imagery of oil storage tanks to predict oil prices, to weather patterns affecting agricultural commodity prices, to mobile app usage indicating consumer spending habits. Alternative data offers novel insights that traditional data sources might not capture.

Predictive analytics in finance is a powerful tool that combines historical and current data across various sources to forecast future events, trends, and behaviors. By leveraging these methods and data sources, financial professionals can gain a competitive edge, mitigate risks, and uncover new opportunities.

Predictive Analytics Models in Finance

Predictive analytics models are statistical or machine learning tools designed to forecast future events or outcomes by analyzing patterns in historical and current data. They use the data from the previous section to drive insights, identify correlations, establish a cause-and-effect relationship – all to provide insights into the future. There are multiple models available, let’s list the most valuable for predictive analytics in finance:

Linear Regression

A fundamental statistical method used to model the relationship between a dependent variable and one or more independent variables. In finance, it can predict stock prices based on factors like market trends and company performance.

Logistic Regression

Useful for binary outcomes, logistic regression can help in predicting the likelihood of a credit default or whether a new customer will subscribe to a financial product.

Decision Trees

This model uses a tree-like graph of decisions and their possible consequences. It’s particularly effective in classifying risk levels of loans or identifying potential fraud transactions based on a series of attribute-based decisions.

Random Forests

An ensemble method that uses multiple decision trees to improve prediction accuracy. It’s robust against overfitting and is used in credit scoring and portfolio risk management.

Neural Networks

Inspired by the structure of the human brain, neural networks are capable of capturing complex patterns and relationships in data. They are used for high-frequency trading, credit scoring, and market analysis due to their ability to learn nonlinear relationships.

Support Vector Machines (SVM)

This model is particularly useful for classification and regression in high-dimensional spaces. In finance, SVMs are used for stock market forecasting and credit risk analysis.

Time Series Analysis

Essential for analyzing financial market data, this method considers the sequence of data points in time. ARIMA (AutoRegressive Integrated Moving Average) is a popular model for forecasting stock prices, economic indicators, and market trends.

Cluster Analysis

Not a predictive model per se but a useful tool for segmenting datasets into clusters with similar characteristics. It can help financial institutions in customer segmentation, targeting marketing strategies, and identifying patterns in investment behavior.

Benefits and Challenges of Predictive Analytics in Finance

I hope the information above is enough to get an overview of the opportunities predictive analytics offers. Nevertheless, every opportunity that brings benefits comes with a challenge, and predictive analytics in finance isn’t an exception.

| Benefit / Challenge | Benefit description | Challenge description |

| Enhanced decision-making / Data quality and availability | Allows financial institutions to make informed decisions based on data-driven insights. | Requires access to high-quality, comprehensive data sets, which may not always be available. |

| Risk management / Model complexity | Enables the identification and assessment of potential risks before they materialize. | Complex models can be difficult to interpret and explain to stakeholders. |

| Fraud detection / Market volatility | Improves the ability to detect and prevent fraudulent activities through pattern recognition. | Rapid changes in market conditions can make predictions less reliable. |

| Customer segmentation / Regulatory constraints | Facilitates targeted marketing by identifying customer behaviors and preferences. | Compliance with evolving financial regulations can be challenging. |

| Operational efficiency / Integration issues | Streamlines financial operations and reduces costs through process optimization. | Difficulties in integrating predictive analytics with existing systems and workflows. |

| Portfolio optimization / Skillset requirement | Aids in constructing and managing investment portfolios to maximize returns. | Requires specialized expertise in data science and finance, which can be scarce. |

| Regulatory compliance / Ethical and privacy concerns | Assists in monitoring and ensuring compliance with financial regulations. | Must navigate ethical issues and ensure data privacy and security. |

13 Use Cases of Predictive Analytics in Finance

Currently, we’ve got the essential details to delve deeper into the topic. Given the diverse array of businesses within the finance sector and the varied purposes served by predictive analytics tools, providing an exhaustive list of applications is challenging.

Nonetheless, I’ll outline 13 of the most prevalent applications that have gained popularity due to their significant implementation value.

#1 Credit Scoring and Risk Management

Predictive analytics are used to assess the creditworthiness of borrowers by analyzing historical financial data, repayment histories, and current financial behaviors. This helps manage lending risks and decide on loan approvals. Back in 2022, JPMorgan Chase, a US multinational financial institution, invested 12 billion in predictive analytics and artificial intelligence technologies. The bank utilizes sophisticated models to analyze vast amounts of data, from transaction histories to social media activity, to assess credit risk more accurately.

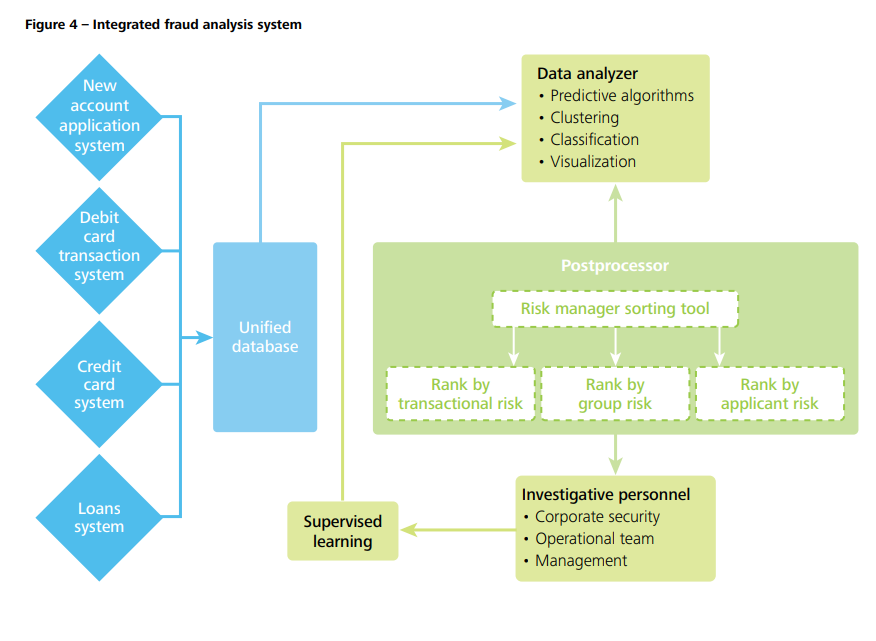

#2 Fraud Detection and Prevention

Financial institutions leverage predictive analytics to identify unusual patterns and anomalies in transaction data, which can indicate fraudulent activities. This proactive approach helps in mitigating financial losses and enhancing security measures. Here is a scheme of how it works from the Deloitte report on predictive analytics, a British multinational company.

#3 Demand Forecasting for Financial Products

Financial institutions can use historical sales data combined with current market trends and consumer behavior analysis to forecast the demand for various financial products and services. According to the Harvard Business School, US, predictive analytics can be used to forecast future cash flow and the overall organization’s future health.

#4 Algorithmic Trading

Predictive analytics are employed in the stock market for algorithmic trading, where historical and real-time market data are analyzed to make automated trading decisions, aiming to maximize returns and minimize risks. Computer algorithms, methods, statistics, and predictive analytics are the backbone of quantitative or algorithmic trading.

#5 Customer Lifetime Value Prediction

Financial firms use predictive analytics to estimate the lifetime value of customers. This involves analyzing transaction histories, service usage patterns, and customer engagement metrics to prioritize and tailor services for high-value Clients.

#6 Portfolio Management

Predictive analytics aid in constructing and adjusting investment portfolios by forecasting market trends, asset price movements, and the potential impact of economic events on investments. Additionally, these analytics can optimize asset allocation and diversification strategies, minimizing risk while targeting desired returns.

#7 Cash Flow Forecasting

By analyzing historical cash flow data, current financial obligations, and expected receivables, predictive analytics help businesses forecast their cash flow, enabling better liquidity management and investment planning.

#8 Churn Prediction

Financial services use predictive analytics to identify customers who are at risk of leaving for a competitor. By analyzing customer activity and engagement levels, firms can take proactive steps to retain these customers.

#9 Regulatory Compliance Monitoring

Predictive models can help in monitoring transactions and behaviors that may indicate non-compliance with regulatory standards, thus allowing institutions to address potential issues proactively.

#10 Operational Efficiency

By analyzing internal processes and transaction data, predictive analytics can identify inefficiencies and bottlenecks in financial operations, suggesting areas for process improvement and cost reduction.

#11 Investment and Trading Strategies

Predictive analytics help in developing and refining investment and trading strategies by analyzing market conditions, investor behavior, and economic indicators. This approach enables traders and fund managers to identify potential investment opportunities and hedge against risks in a volatile market.

#12 Market Analysis and Forecasting

This involves using predictive analytics to understand and forecast market trends, helping investors and financial institutions make informed decisions. By analyzing historical data and current market signals, firms can anticipate market movements to optimize investment timing and asset allocation.

#13 Asset and Liability Management (ALM)

Predictive analytics are crucial in managing the balance between assets and liabilities, ensuring that financial institutions can meet their obligations and optimize their interest margins. It involves forecasting interest rates, cash flows, and asset values to mitigate risks associated with changes in market conditions.

SumatoSoft: The Provider of Predictive Analytics in Finance

The article is written based on the information from our knowledge base and case studies we dealt with. SumatoSoft is a reliable software developer that has been operating in the market since 2012. The range of our services for finance organizations includes:

- enterprise software development;

- finance software development;

- artificial intelligence development;

- big data services;

- machine learning development;

- ChatGPT app development services;

- blockchain consulting;

- blockchain development.

Facts about SumatoSoft:

- We strive for quality and security, and ISO 27001 and ISO 9001 certificates can prove it.

- We focus on long-term cooperation. 70% of our Clients come back to us with another project.

- Our Client’s satisfaction rate is 98%, thanks to our firm commitment to deadlines and their needs.

- Your project data stays safe. We guarantee the security of all data related to your project

- We only release the software if it meets the specified percentage of acceptance criteria. The percentage is agreed upon with you in the quality assurance strategy.

- 70% of our team is made up of senior-level developers and QA engineers who ensure the app complies with domain best practices and our inner quality assurance guidelines.

The Rivalfox had the pleasure to work with SumatoSoft in building out core portions of our product, and the results really couldn’t have been better.

SumatoSoft supercharged our productivity by providing us with three team members whose technological expertise was surpassed only by their enthusiasm. Many times they found better solutions than were given to them, and with that alongside their excellent ability to communication, they made our product better, faster, which resulted in customers becoming happier sooner. SumatoSoft provided us with engineering expertise, enthusiasm and great people that were focused on creating quality features quickly.

We became a reliable technical partner to its Clients, demonstrating a 98% Client satisfaction rate with the quality of services they provide. Contact us to get a free quote for your project.

Predictive Analytics in Finance: Look Into the Future

As we wrap up our dive into predictive analytics in finance, it’s impossible not to feel a buzz of excitement about what lies ahead. This isn’t just about crunching numbers or predicting trends; it’s about opening the door to a future where financial foresight shapes our decisions, strategies, and innovations.

Imagine the possibilities when we can outsmart risks, tailor experiences to individual needs before they’re even voiced, and navigate the complexities of the financial world with confidence.We’re not just observers on this journey; we’re active participants, shaping a future where predictive analytics in finance transforms possibilities into realities. Let’s embrace this fascinating journey together, fueled by curiosity and the promise of what’s to come. Get in touch!

Let’s start

If you have any questions, email us info@sumatosoft.com